Page 35 - Portfolio Analysis

P. 35

In figure 18 above, the total cash generated equals 240 units whilst the

cash used also equals 240 units. For simplicity’s sake the net resources of

the cash cow and dog segments are used to offset the shortfall in the star

and problem child segments. In particular, the star segment shows the 20

units being used to fund further research and development and distribution

channels. The remaining 80 units are used in the question mark quadrant.

STRATEGIC IMPLICATIONS

The product portfolio is helped not only because it facilitates the

development of strategies for specific products but also because it so

effectively potrrays the overall strategic position of the multi-product/mult-

division company. In the latter case the growth/share matrix is created by

dividing the company into its component businesses or segments, each of

which is capable of standing alone. These SBUs are then subjected to

similar analysis to that of products. From this a prognisis of how a

company’s portfolio might look in, say, five years time may be developed.

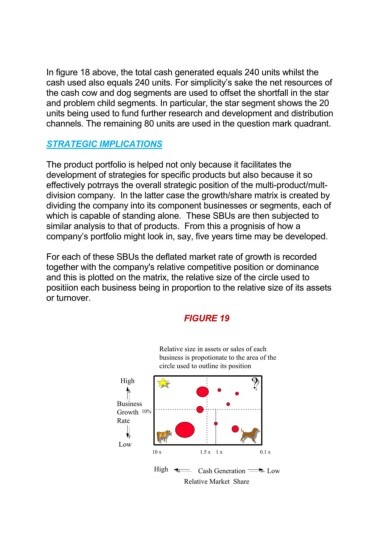

For each of these SBUs the deflated market rate of growth is recorded

together with the company's relative competitive position or dominance

and this is plotted on the matrix, the relative size of the circle used to

positiion each business being in proportion to the relative size of its assets

or turnover.

FIGURE 19

Relative size in assets or sales of each

business is propotionate to the area of the

circle used to outline its position

High ?

?

Business

Growth 10%

Rate

Low

10 x 1.5 x 1 x 0.1 x

High Cash Generation Low

Relative Market Share