Page 36 - Portfolio Analysis

P. 36

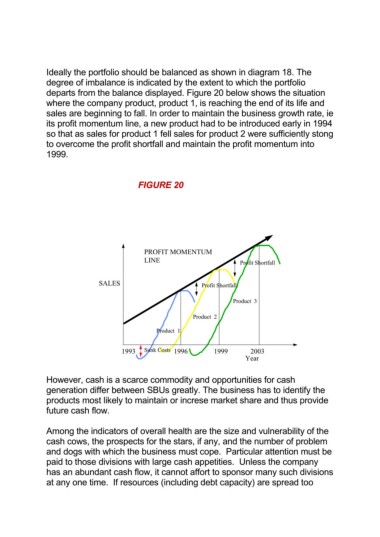

Ideally the portfolio should be balanced as shown in diagram 18. The

degree of imbalance is indicated by the extent to which the portfolio

departs from the balance displayed. Figure 20 below shows the situation

where the company product, product 1, is reaching the end of its life and

sales are beginning to fall. In order to maintain the business growth rate, ie

its profit momentum line, a new product had to be introduced early in 1994

so that as sales for product 1 fell sales for product 2 were sufficiently stong

to overcome the profit shortfall and maintain the profit momentum into

1999.

FIGURE 20

PROFIT MOMENTUM

LINE

Profit Shortfall

SALES Profit Shortfall

Product 3

Product 2

Product 1

1993 Sunk Costs 1996 1999 2003

Year

However, cash is a scarce commodity and opportunities for cash

generation differ between SBUs greatly. The business has to identify the

products most likely to maintain or increse market share and thus provide

future cash flow.

Among the indicators of overall health are the size and vulnerability of the

cash cows, the prospects for the stars, if any, and the number of problem

and dogs with which the business must cope. Particular attention must be

paid to those divisions with large cash appetities. Unless the company

has an abundant cash flow, it cannot affort to sponsor many such divisions

at any one time. If resources (including debt capacity) are spread too