Page 18 - Property Summary Guardian Place 1 12 2022 Reduced File - With Cover Pages

P. 18

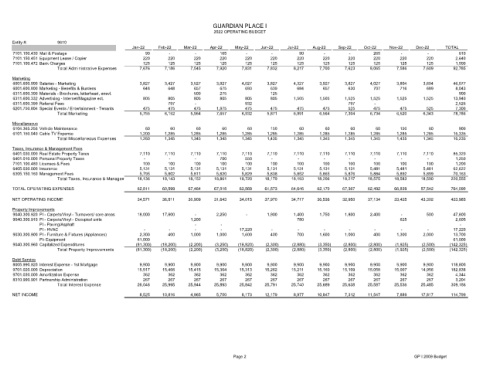

GUARDIAN PLACE I

2022 OPERATING BUDGET

Entity #: 9610

Jan-22 Feb-22 Mar-22 Apr-22 May-22 Jun-22 Jul-22 Aug-22 Sep-22 Oct-22 Nov-22 Dec-22 TOTAL

7101.100.430 Mail & Postage 90 - - 165 - - 90 - - 265 - - 610

7101.150.451 Equipment Lease / Copier 220 220 220 220 220 220 220 220 220 220 220 220 2,640

7101.100.472 Bank Charges 125 125 125 125 125 125 125 125 125 125 125 125 1,500

Total Administrative Expenses 7,676 7,186 7,545 7,920 7,831 7,832 8,217 7,700 7,623 8,065 7,586 7,609 92,785

Marketing

6001.600.900 Salaries - Marketing 3,827 3,427 3,527 3,927 4,027 3,827 4,327 3,927 3,827 4,027 3,804 3,604 46,077

6001.600.800 Marketing - Benefits & Burdens 648 648 657 675 693 639 684 657 630 707 716 689 8,043

6311.600.300 Materials - Brochures, letterhead, enevl. 500 275 125 900

6311.600.332 Advertising - Internet/Magazine ect. 805 805 805 805 805 805 1,505 1,505 1,525 1,525 1,525 1,525 13,940

6311.600.399 Referral Fees 797 - 932 797 - 2,526

6201.750.804 Special Events / Entertainment - Tenants 475 475 475 1,975 475 475 475 475 525 475 475 525 7,300

Total Marketing 5,755 6,152 5,964 7,657 6,932 5,871 6,991 6,564 7,304 6,734 6,520 6,343 78,786

Miscellaneous

6104.365.256 Vehicle Maintenance 60 60 60 60 60 150 60 60 60 60 150 60 900

6101.150.040 Cable TV Expense 1,200 1,285 1,285 1,285 1,285 1,285 1,285 1,285 1,285 1,285 1,285 1,285 15,335

Total Miscellaneous Expenses 1,260 1,345 1,345 1,345 1,345 1,435 1,345 1,345 1,345 1,345 1,435 1,345 16,235

Taxes, Insurance & Management Fees

6401.030.000 Real Estate Property Taxes 7,110 7,110 7,110 7,110 7,110 7,110 7,110 7,110 7,110 7,110 7,110 7,110 85,320

6401.010.000 Personal Property Taxes - - - 700 550 - - - - - - - 1,250

7101.100.480 Licenses & Fees 100 100 100 100 100 100 100 100 100 100 100 100 1,200

6405.030.000 Insurance 5,131 5,131 5,131 5,131 5,131 5,131 5,131 5,131 5,131 5,481 5,481 5,481 62,622

6305.150.160 Management Fees 5,795 5,802 5,811 5,820 5,829 5,838 5,852 5,865 5,876 5,884 5,892 5,899 70,163

Total Taxes, Insurance & Managem 18,136 18,143 18,152 18,861 18,720 18,179 18,193 18,206 18,217 18,575 18,583 18,590 220,555

TOTAL OPERATING EXPENSES 62,811 60,599 67,464 67,018 63,569 61,573 64,646 62,170 67,367 62,492 66,839 57,542 764,090

NET OPERATING INCOME 34,571 36,811 30,909 31,643 34,015 37,970 34,717 36,536 32,950 37,134 33,425 43,302 423,985

Property Improvements

9040.300.920 PI - Carpets/Vinyl - Turnovers/ core areas 18,000 17,800 - 2,250 - 1,900 1,400 1,750 1,800 2,400 - 500 47,800

9040.300.910 PI - Carpets/Vinyl - Occupied units 1,200 780 625 2,605

PI - Paving/Asphalt - - -

PI - HVAC - - - - 17,220 - - - - - - - 17,220

9030.300.900 PI - Furniture & Fixtures (Appliances) 2,300 400 1,000 1,000 1,600 400 700 1,600 1,000 400 1,300 2,000 13,700

PI- Equipment 61,000 61,000

9040.300.960 Capitalized Expenditures (81,300) (18,200) (2,200) (3,250) (18,820) (2,300) (2,880) (3,350) (2,800) (2,800) (1,925) (2,500) (142,325)

Total Property Improvements (81,300) (18,200) (2,200) (3,250) (18,820) (2,300) (2,880) (3,350) (2,800) (2,800) (1,925) (2,500) (142,325)

Debt Service

8005.990.920 Interest Expense - 1st Mortgage 9,900 9,900 9,900 9,900 9,900 9,900 9,900 9,900 9,900 9,900 9,900 9,900 118,800

9701.020.000 Depreciation 15,517 15,466 15,415 15,364 15,313 15,262 15,211 15,160 15,109 15,058 15,007 14,956 182,838

9701.030.000 Amortization Expense 362 362 362 362 362 362 362 362 362 362 362 362 4,344

8310.990.901 Partnership Administration 267 267 267 267 267 267 267 267 267 267 267 267 3,204

Total Interest Expense 26,046 25,995 25,944 25,893 25,842 25,791 25,740 25,689 25,638 25,587 25,536 25,485 309,186

NET INCOME 8,525 10,816 4,965 5,750 8,173 12,179 8,977 10,847 7,312 11,547 7,889 17,817 114,799

Page 2 GP I 2009 Budget