Page 5 - Guardian Broker Questionnaire Summary Complete Package 2 2 22_Neat

P. 5

Broker Questionnaire

Brokerage

Company/Team

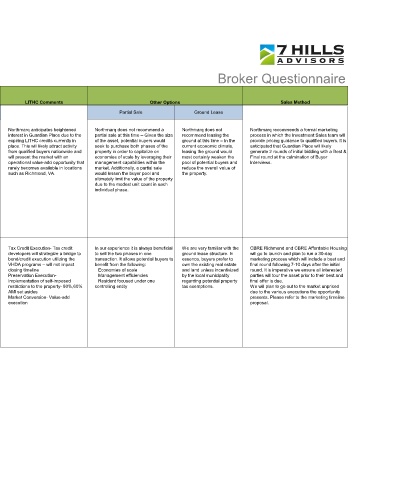

Location Similar Properties Sold Pricing, Timing & Fees LITHC Comments Other Options Sales Method

Range Stretch Price Timing Fees Partial Sale Ground Lease

Chesapeake Crossing 2021-597 Units Non-Profit: $20-22M $26M Marketing/Property Tours 4 1.25% Northmarq anticipates heightened Northmarq does not recommend a Northmarq does not Northmarq recommends a formal marketing

Waverton Porfolio (Norfolk) 2021-763 Profit: $24-25M Weeks interest in Guardian Place due to the partial sale at this time – Given the size recommend leasing the process in which the Investment Sales team will

Units First/Second Round expiring LITHC credits currently in of the asset, potential buyers would ground at this time – In the provide pricing guidance to qualified buyers. It is

Mayfair (VA Beach) 2019-197 Units Offers/Best & Final 2 Weeks place. This will likely attract activity seek to purchase both phases of the current economic climate, anticipated that Guardian Place will likely

Hampton (Va Beach) 2019-212 Units Final Interviews 1 Week from qualified buyers nationwide and property in order to capitalize on leasing the ground would generate 2 rounds of initial bidding with a Best &

Silver Hill at Arboretum (Newport News) DD/Closing 60 Days will present the market with an economies of scale by leveraging their most certainly weaken the Final round at the culmination of Buyer

2016-153 Units operational value-add opportunity that management capabilities within the pool of potential buyers and Interviews.

rarely becomes available in locations market. Additionally, a partial sale reduce the overall value of

such as Richmond, VA. would lessen the buyer pool and the property.

ultimately limit the value of the property

due to the modest unit count in each

Wink Ewing individual phase.

Matt Straughan

Richmond, VA

Ashburn VA 2017- 176 Units $29.7M -$32.25M $32.25M It will take our team Original Tax Credit Execution- Tax credit In our experience it is always beneficial We are very familiar with the CBRE Richmond and CBRE Affordable Housing

Fredericksburg VA 2020- 204 Units approximately two weeks to Response was developers will strategize a bridge to to sell the two phases in one ground lease structure. In will go to launch and plan to run a 30-day

Leesburg VA 2017- 157 Units prep the offering work with client bond/credit execution utilizing the transaction. It allows potential buyers to essence, buyers prefer to marketing process which will include a best and

Alexandria VA 2019- 290 Units memorandum, schedule on case by VHDA programs – will not impact benefit from the following: own the existing real estate final round following 7-10 days after the initial

photography, and tour the case: closing timeline Economies of scale and land unless incentivized round. It is imperative we ensure all interested

asset Requested Preservation Execution- Management efficiencies by the local municipality parties will tour the asset prior to their best and

Approximately 40-day specifics: Implementation of self-imposed Resident focused under one regarding potential property final offer is due.

marketing process which Response was restrictions to the property- 80%,60% controlling entity tax exemptions. We will plan to go out to the market unpriced

includes best and final 1.25% of sale AMI set asides due to the various executions the opportunity

Conventional closing price, or Market Conversion- Value-add presents. Please refer to the marketing timeline

Peyton Cox timeframe is ~75-90 days. incentives over execution proposal.

Calvin Griffith list price, which

Richmond, VA works well in

certain

scenarios (not

recommended

on this project)