Page 6 - Guardian Broker Questionnaire Summary Complete Package 2 2 22_Neat

P. 6

Broker Questionnaire

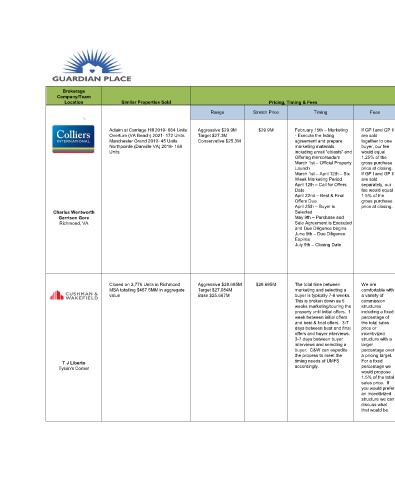

Brokerage

Company/Team

Location Similar Properties Sold Pricing, Timing & Fees LITHC Comments Other Options Sales Method

Range Stretch Price Timing Fees Partial Sale Ground Lease

Aclaim at Carriage Hill 2019- 664 Units Aggressive $29.9M $29.9M February 15th – Marketing If GP I and GP II The expiration of the affordable The benefits of currently marketing We do not downplay the Colliers would run a traditional marketing

Overture (VA Beach) 2021- 172 Units Target $27.3M - Execute the listing are sold component at Guardian Place I in both properties are significant. Buyers advantages of a ground process. The overall timing is typically 19-21

Manchester Grand 2019- 45 Units Conservative $25.3M agreement and prepare together to one coming years allows a buyer to begin have a very desirable and favorable lease scenario for current weeks from execution of Listing Agreement to

Northpointe (Danville VA) 2018- 168 marketing materials buyer, our fee implementing a value-add strategy that lending environment with interest rates ownership and this will be Closing. While we do not publish an “offer

Units including email “eblasts” and would equal will ultimately result in more aggressive still at historically low levels. Financing completely vetted out during price,” we do provide a “whisper price” or

Offering memorandum 1.25% of the pricing for ownership. Our execution is also diverse as buyers may utilize the marketing period. We do guidance number. This guidance number is “at

March 1st – Official Property gross purchase strategy and underwriting notes for many competitive debt instruments see this potentially limiting the or near” the target price to entice as many offers

Launch price at closing. Guardian Place I show a timeline of including fixed, floating rate, and bridge buyer pool and believe a as possible. This leads to competitive rounds of

March 1st – April 12th – Six If GP I and GP II converting current affordable units to lending that leads to higher yields for traditional execution will bidding, essentially creating an auction-style

Week Marketing Period are sold market rate over a four-year period. A the buyer and more aggressive pricing attract broader investor process.

April 12th – Call for Offers separately, our buyer will invest significant capital to for the seller. interest.

Date fee would equal upgrade interiors, add property

April 22nd – Best & Final 1.5% of the amenities, and enhance the curb

Offers Due gross purchase appeal of the property, increasing

April 25th – Buyer is price at closing. rents and providing attractive returns

Charles Wentworth Selected for new ownership. Unlike most

Garrison Gore May 9th – Purchase and traditional value-add, market-rate

Richmond, VA Sale Agreement is Executed opportunities, this execution strategy

and Due Diligence begins will take extended time as a new buyer

June 9th – Due Diligence will anticipate lower overall turnover

Expires rates at the property particularly in the

July 9th – Closing Date early years. The three year “lockout”

period following the extended use

period will also delay the renovation

schedule.

Closed on 2,776 Units in Richmond Aggressive $28.685M $28.685M The total time between We are Traditional investors in “market rate” Both assets are highly desirable and The only benefit would be to We conduct a blind auction process where we

MSA totalling $457.5MM in aggregate Target $27.084M marketing and selecting a comfortable with multifamily are competing for LIHTC would be well received in the market no create a long term income market the assets through e-blasts, phone calls,

value Base $25.667M buyer is typically 7-8 weeks. a variety of properties as a way to compete in the matter when they were sold. Because stream back to UMFS but this and investor tours for approximately 4-6 weeks.

This is broken down as 5 commission overheated investment market. These of the differences we would would be at the expense of After marketing we call for an initial round of

weeks marketing/touring the structures investors will purchase the assets and recommend putting both to market at up front value of the offers followed by a best and final round of

property until initial offers. 1 including a fixed remain compliant with the affordability the same time as a portfolio with the buildings. There are less offers. We typically conduct buyer interview

week between initial offers percentage of through the extended use period and optionality of acquiring one or both. groups who buy assets on a calls with C&W, UMFS and the top groups after

and best & final offers. 3-7 the total sales either sell the asset to a group to This allows groups who want to realize ground lease than those who the B&F round so UMFS can get acclimated

days between best and final price or increase the rents to “market rate” or the mark to market strategy or re- buy fee simple transactions, with who the groups are, their plans, capital, etc.

offers and buyer interviews. incentivized do this themselves. Traditional syndicate the credits immediately the either because they cannot Typically we give a final counter to the group

3-7 days between buyer structure with a “market rate” investors will purchase ability to with Guardian Place I only. (investment capital raised UMFS decides they want to do business with to

interviews and selecting a larger Guardian Place I specifically to do this The deal size for both assets predicated on fee simple try to extract more purchase price, terms or both

buyer. C&W can expedite percentage over given the timing of the expiration of (individually and as a portfolio) is very purchases only) or will not after the buyer interview. The market is very

the process to meet the a pricing target. extended use period. There are many attractive for a variety of capital types. because of the nuance. In competitive and there are groups who will want

T J Liberto timing needs of UMFS For a fixed investors that purchase only LIHTC or Larger investors will only be interested our experience the cap rate is to take the property off the market either before

Tyson's Corner accordingly. percentage we affordable properties and these groups in the two properties together and reduced by 25bps – 35bps if or during the process. The process yields the

would propose would be involved in the process as having groups interested in individual a property is being sold most in price but achieving an acceptable value

1.5% of the total well. These groups will purchase the assets will add competition to portfolio subject to a ground lease, without having to run a full marketing also has

sales price. If assets to re-syndicate the tax credits at purchasers. Maximizing the amount of which in this example would benefits to certain owners. C&W can discuss in

you would prefer the expiration of the extended use groups engaged to purchase the also be applied to a lower more detail the pros and cons of this strategy

an incentivized period. asset(s) through optionality will NOI that would take into should UMFS want to entertain or be interested

structure we can enhance the overall buyer pool, create account the expense of the in this structure.

discuss what additional competition and yield more new ground lease.

that would be. in price.