Page 15 - webmechanix

P. 15

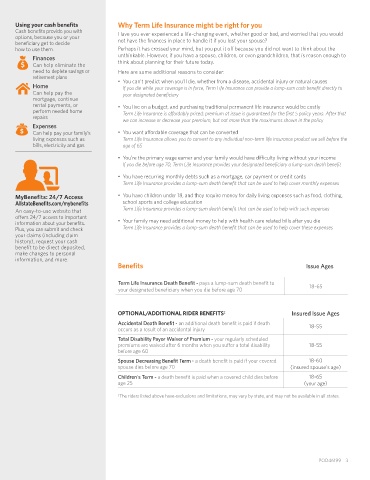

Using your cash benefits Why Term Life Insurance might be right for you

Cash benefits provide you with Have you ever experienced a life-changing event, whether good or bad, and worried that you would

options, because you or your

beneficiary get to decide not have the finances in place to handle it if you lost your spouse?

how to use them. Perhaps it has crossed your mind, but you put it off because you did not want to think about the

Finances unthinkable. However, if you have a spouse, children, or even grandchildren, that is reason enough to

Can help eliminate the think about planning for their future today.

need to deplete savings or Here are some additional reasons to consider:

retirement plans • You can’t predict when you’ll die, whether from a disease, accidental injury or natural causes

Home If you die while your coverage is in force, Term Life Insurance can provide a lump-sum cash benefit directly to

Can help pay the your designated beneficiary

mortgage, continue

rental payments, or • You live on a budget, and purchasing traditional permanent life insurance would be costly

perform needed home Term Life Insurance is affordably priced; premium at issue is guaranteed for the first 5 policy years. After that

repairs we can increase or decrease your premium, but not more than the maximums shown in the policy

Expenses

Can help pay your family’s • You want affordable coverage that can be converted

living expenses such as Term Life Insurance allows you to convert to any individual non-term life insurance product we sell before the

bills, electricity and gas age of 65

• You’re the primary wage earner and your family would have difficulty living without your income

If you die before age 70, Term Life Insurance provides your designated beneficiary a lump-sum death benefit

• You have recurring monthly debts such as a mortgage, car payment or credit cards

Term Life Insurance provides a lump-sum death benefit that can be used to help cover monthly expenses

MyBenefits: 24/7 Access • You have children under 18, and they require money for daily living expenses such as food, clothing,

AllstateBenefits.com/mybenefits school sports and college education

An easy-to-use website that Term Life Insurance provides a lump-sum death benefit that can be used to help with such expenses

offers 24/7 access to important

information about your benefits. • Your family may need additional money to help with health care related bills after you die

Plus, you can submit and check Term Life Insurance provides a lump-sum death benefit that can be used to help cover these expenses

your claims (including claim

history), request your cash

benefit to be direct deposited,

make changes to personal

information, and more.

Benefits Issue Ages

Term Life Insurance Death Benefit - pays a lump-sum death benefit to 18-65

your designated beneficiary when you die before age 70

OPTIONAL/ADDITIONAL RIDER BENEFITS ‡ Insured Issue Ages

Accidental Death Benefit -^ an additional death benefit is paid if death 18-55

occurs as a result of an accidental injury

Total Disability Payor Waiver of Premium -^ your regularly scheduled

premiums are waived after 6 months when you suffer a total disability 18-55

before age 60

Spouse Decreasing Benefit Term -^ a death benefit is paid if your covered 18-60

spouse dies before age 70 (insured spouse's age)

Children's Term -^ a death benefit is paid when a covered child dies before 18-65

age 25 (your age)

‡ The riders listed above have exclusions and limitations, may vary by state, and may not be available in all states.

POD46199 3