Page 47 - NEW FOREX FULL COURSE

P. 47

FOREX TRADING COURSE FOR BEGINNERS

ADDITIONAL GAPS

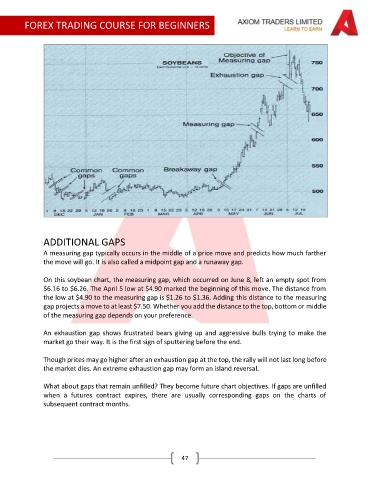

A measuring gap typically occurs in the middle of a price move and predicts how much farther

the move will go. It is also called a midpoint gap and a runaway gap.

On this soybean chart, the measuring gap, which occurred on June 8, left an empty spot from

$6.16 to $6.26. The April 5 low at $4.90 marked the beginning of this move. The distance from

the low at $4.90 to the measuring gap is $1.26 to $1.36. Adding this distance to the measuring

gap projects a move to at least $7.50. Whether you add the distance to the top, bottom or middle

of the measuring gap depends on your preference.

An exhaustion gap shows frustrated bears giving up and aggressive bulls trying to make the

market go their way. It is the first sign of sputtering before the end.

Though prices may go higher after an exhaustion gap at the top, the rally will not last long before

the market dies. An extreme exhaustion gap may form an island reversal.

What about gaps that remain unfilled? They become future chart objectives. If gaps are unfilled

when a futures contract expires, there are usually corresponding gaps on the charts of

subsequent contract months.

47