Page 15 - MSME BULLETIN 2022 .indd

P. 15

MSME & START-UP BULLETIN, VOLUME 1, ISSUE 1, AUGUST 2022

and public trust. The conclude that stakeholder today and coming days. He concludes that NDS or

protection has a signifi cantly positive impact on SME native digital securities will be the game changer for

CSR activities.(Agustina & Clara, 2021) show that raising funds and governance.

CSR impacts the underpricing or overpricing of SME

IPOs in Indonesia.(Li et al., 2019) investigate trust and Research gap and data collection

IPO underpricing of fi rms in China and show that fi rms We fi nd that there is little research done in the

in high social trust have less underpricing and also that correlation between CSR disclosures and activities

trust is more prominent in asymmetric information undertaken by fi rms in SME and their impact if these

environment. fi rms go for an IPO. There are research works in this

area in Indonesia, Italy, etc., but none that authors

The game change ICO and STO found in India. The authors therefore took firms

(Mazzorana-Kremer, 2019) study ICO and STOs as which went for IPO in India and collected the CSR

an alternative to SME IPOs. The research has shows that data provided in their investment portfolio. We found

the blockchain technology offers a unique opportunity literature on success factors of tokens and digital coin

to raise equity more effi ciently. The success of STOs offerings but none where CSR or ESG was cited as a

will be dependent on factors like quality of their issuers factor.

, specialised platforms, and interoperability across

platforms. (Hakizimana, 2020) in his thesis shows that Data of fi rms

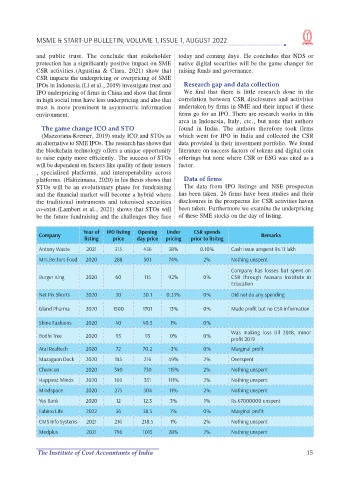

STOs will be an evolutionary phase for fundraising The data from IPO listings and NSE prospectus

and the fi nancial market will become a hybrid where has been taken. 26 fi rms have been studies and their

the traditional instruments and tokenised securities disclosures in the prospectus for CSR activities haven

co-exist.(Lambert et al., 2021) shows that STOs will been taken. Furthermore we examine the underpricing

be the future fundraising and the challenges they face of these SME stocks on the day of listing.

Year of IPO listing Opening Under CSR spends

Company Remarks

listing price day price pricing prior to lisitng

Antony Waste 2021 315 436 38% 0.10% Cash issue unspent Rs.11 lakh

Mrs.Bectors Food 2020 288 501 74% 2% Nothing unspent

Company has losses but spent on

Burger King 2020 60 115 92% 0% CSR through Avasara Institute in

Education

Net Pix Shorts 2020 30 30.1 0.33% 0% Did not do any spending

Gland Pharma 2020 1500 1701 13% 0% Made profit but no CSR information

Shine Fashions 2020 40 40.5 1% 0%

Was making loss till 2018, minor

Bodhi Tree 2020 95 95 0% 0%

profit 2019

Atal Realtech 2020 72 70.2 -3% 0% Marginal profit

Mazagaon Dock 2020 145 216 49% 2% Overspent

Chemcon 2020 340 730 115% 2% Nothing unspent

Happiest Minds 2020 166 351 111% 2% Nothing unspent

Mindspace 2020 275 304 11% 2% Nothing unspent

Yes Bank 2020 12 12.3 3% 1% Rs.67000000 unspent

Fabino Life 2022 36 38.5 7% 0% Marginal profit

CMS Info Systems 2021 216 218.5 1% 2% Nothing unspent

Medplus 2021 796 1015 28% 2% Nothing unspent

The Institute of Cost Accountants of India 15