Page 20 - Financial Statement Analysis

P. 20

sub79433_fm.qxd 4/16/08 6:32 PM Page xvii

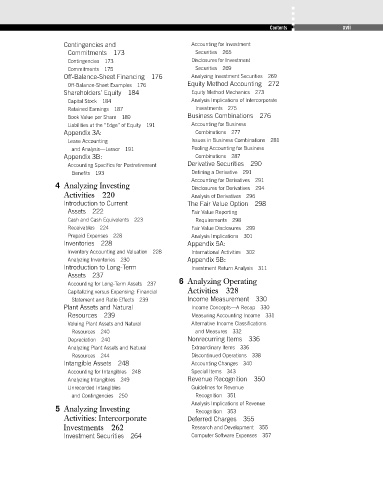

Contents xvii

Contingencies and Accounting for Investment

Commitments 173 Securities 265

Contingencies 173 Disclosures for Investment

Commitments 175 Securities 269

Off-Balance-Sheet Financing 176 Analyzing Investment Securities 269

Off-Balance-Sheet Examples 176 Equity Method Accounting 272

Shareholders’ Equity 184 Equity Method Mechanics 273

Capital Stock 184 Analysis Implications of Intercorporate

Retained Earnings 187 Investments 275

Book Value per Share 189 Business Combinations 276

Liabilities at the “Edge” of Equity 191 Accounting for Business

Appendix 3A: Combinations 277

Lease Accounting Issues in Business Combinations 281

and Analysis—Lessor 191 Pooling Accounting for Business

Appendix 3B: Combinations 287

Accounting Specifics for Postretirement Derivative Securities 290

Benefits 193 Defining a Derivative 291

Accounting for Derivatives 291

4 Analyzing Investing Disclosures for Derivatives 294

Activities 220 Analysis of Derivatives 296

Introduction to Current The Fair Value Option 298

Assets 222 Fair Value Reporting

Cash and Cash Equivalents 223 Requirements 298

Receivables 224 Fair Value Disclosures 299

Prepaid Expenses 228 Analysis Implications 301

Inventories 228 Appendix 5A:

Inventory Accounting and Valuation 228 International Activities 302

Analyzing Inventories 230 Appendix 5B:

Introduction to Long-Term Investment Return Analysis 311

Assets 237

6 Analyzing Operating

Accounting for Long-Term Assets 237

Capitalizing versus Expensing: Financial Activities 328

Statement and Ratio Effects 239 Income Measurement 330

Plant Assets and Natural Income Concepts—A Recap 330

Resources 239 Measuring Accounting Income 331

Valuing Plant Assets and Natural Alternative Income Classifications

Resources 240 and Measures 332

Depreciation 240 Nonrecurring Items 336

Analyzing Plant Assets and Natural Extraordinary Items 336

Resources 244 Discontinued Operations 338

Intangible Assets 248 Accounting Changes 340

Accounting for Intangibles 248 Special Items 343

Analyzing Intangibles 249 Revenue Recognition 350

Unrecorded Intangibles Guidelines for Revenue

and Contingencies 250 Recognition 351

Analysis Implications of Revenue

5 Analyzing Investing Recognition 353

Activities: Intercorporate Deferred Charges 355

Investments 262 Research and Development 355

Investment Securities 264 Computer Software Expenses 357