Page 22 - Financial Statement Analysis

P. 22

sub79433_fm.qxd 4/16/08 6:32 PM Page xix

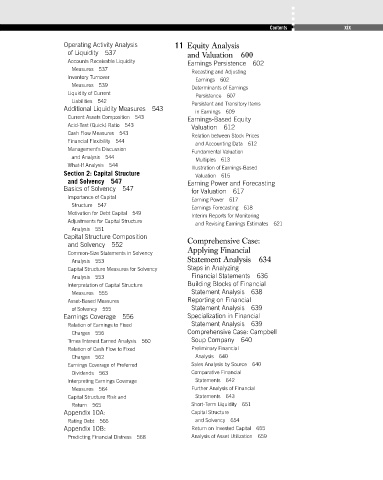

Contents xix

Operating Activity Analysis 11 Equity Analysis

of Liquidity 537 and Valuation 600

Accounts Receivable Liquidity

Earnings Persistence 602

Measures 537

Recasting and Adjusting

Inventory Turnover

Earnings 602

Measures 539

Determinants of Earnings

Liquidity of Current

Persistence 607

Liabilities 542

Persistent and Transitory Items

Additional Liquidity Measures 543

in Earnings 609

Current Assets Composition 543

Earnings-Based Equity

Acid-Test (Quick) Ratio 543

Valuation 612

Cash Flow Measures 543

Relation between Stock Prices

Financial Flexibility 544

and Accounting Data 612

Management’s Discussion

Fundamental Valuation

and Analysis 544

Multiples 613

What-If Analysis 544

Illustration of Earnings-Based

Section 2: Capital Structure Valuation 615

and Solvency 547 Earning Power and Forecasting

Basics of Solvency 547

for Valuation 617

Importance of Capital

Earning Power 617

Structure 547

Earnings Forecasting 618

Motivation for Debt Capital 549

Interim Reports for Monitoring

Adjustments for Capital Structure

and Revising Earnings Estimates 621

Analysis 551

Capital Structure Composition Comprehensive Case:

and Solvency 552

Applying Financial

Common-Size Statements in Solvency

Analysis 553 Statement Analysis 634

Capital Structure Measures for Solvency Steps in Analyzing

Analysis 553 Financial Statements 636

Interpretation of Capital Structure Building Blocks of Financial

Measures 555 Statement Analysis 638

Asset-Based Measures Reporting on Financial

of Solvency 555 Statement Analysis 639

Earnings Coverage 556 Specialization in Financial

Relation of Earnings to Fixed Statement Analysis 639

Charges 556 Comprehensive Case: Campbell

Times Interest Earned Analysis 560 Soup Company 640

Relation of Cash Flow to Fixed Preliminary Financial

Charges 562 Analysis 640

Earnings Coverage of Preferred Sales Analysis by Source 640

Dividends 563 Comparative Financial

Interpreting Earnings Coverage Statements 642

Measures 564 Further Analysis of Financial

Capital Structure Risk and Statements 643

Return 565 Short-Term Liquidity 651

Appendix 10A: Capital Structure

Rating Debt 566 and Solvency 654

Appendix 10B: Return on Invested Capital 655

Predicting Financial Distress 568 Analysis of Asset Utilization 659