Page 138 - Hudson City Schools CAFR 2017

P. 138

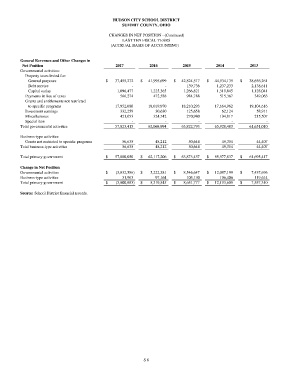

HUDSON CITY SCHOOL DISTRICT

SUMMIT COUNTY, OHIO

CHANGES IN NET POSITION - (Continued)

LAST TEN FISCAL YEARS

(ACCRUAL BASIS OF ACCOUNTING)

General Revenues and Other Changes in

Net Position 2017 2016 2015 2014 2013

Governmental activities:

Property taxes levied for:

General purposes $ 37,455,272 $ 41,995,699 $ 42,824,517 $ 44,934,135 $ 38,656,261

Debt service - - 139,736 1,237,233 2,138,611

Capital outlay 1,096,477 1,225,365 1,266,821 1,319,845 1,128,041

Payments in lieu of taxes 566,274 472,588 984,788 515,367 349,063

Grants and entitlements not restricted

to specific programs 17,952,080 18,019,970 18,210,293 17,664,962 19,104,616

Investment earnings 332,259 30,630 125,658 62,124 58,911

Miscellaneous 421,053 324,742 270,980 194,817 215,507

Special item - - - - -

Total governmental activities 57,823,415 62,068,994 63,822,793 65,928,483 61,651,010

Business-type activities:

Grants not restricted to specific programs 56,635 48,212 50,644 49,354 44,407

Total business-type activities 56,635 48,212 50,644 49,354 44,407

Total primary government $ 57,880,050 $ 62,117,206 $ 63,873,437 $ 65,977,837 $ 61,695,417

Change in Net Position

Governmental activities $ (3,832,586) $ 5,222,381 $ 8,546,647 $ 12,087,199 $ 7,437,696

Business-type activities 31,903 97,164 105,130 106,406 119,614

Total primary government $ (3,800,683) $ 5,319,545 $ 8,651,777 $ 12,193,605 $ 7,557,310

Source: School District financial records.

S 8