Page 30 - Hudson City Schools CAFR 2017

P. 30

HUDSON CITY SCHOOL DISTRICT

SUMMIT COUNTY, OHIO

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE FISCAL YEAR ENDED JUNE 30, 2017

(UNAUDITED)

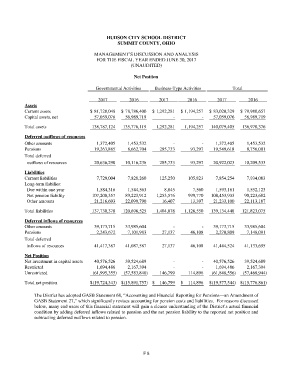

Net Position

Governmental Activities Business-Type Activities Total

2017 2016 2017 2016 2017 2016

Assets

Current assets $ 81,728,048 $ 78,786,400 $ 1,292,281 $ 1,194,257 $ 83,020,329 $ 79,980,657

Capital assets, net 57,059,076 56,989,719 - - 57,059,076 56,989,719

Total assets 138,787,124 135,776,119 1,292,281 1,194,257 140,079,405 136,970,376

Deferred outflows of resources

Other amounts 1,372,405 1,453,532 - - 1,372,405 1,453,532

Pensions 19,263,885 8,662,704 285,733 93,297 19,549,618 8,756,001

Total deferred

outflows of resources 20,636,290 10,116,236 285,733 93,297 20,922,023 10,209,533

Liabilities

Current liabilities 7,729,004 7,828,260 125,250 105,823 7,854,254 7,934,083

Long-term liabilies:

Due within one year 1,584,316 1,544,563 8,845 7,560 1,593,161 1,552,123

Net pension liability 107,200,357 89,223,912 1,253,576 999,770 108,453,933 90,223,682

Other amounts 21,216,693 22,099,790 16,407 13,397 21,233,100 22,113,187

Total liabilities 137,730,370 120,696,525 1,404,078 1,126,550 139,134,448 121,823,075

Deferred inflows of resources

Other amounts 39,173,715 33,985,604 - - 39,173,715 33,985,604

Pensions 2,243,672 7,101,983 27,137 46,108 2,270,809 7,148,091

Total deferred

inflows of resources 41,417,387 41,087,587 27,137 46,108 41,444,524 41,133,695

Net Position

Net investment in capital assets 40,576,526 39,524,689 - - 40,576,526 39,524,689

Restricted 1,694,486 2,167,394 - - 1,694,486 2,167,394

Unrestricted (61,995,355) (57,583,840) 146,799 114,896 (61,848,556) (57,468,944)

Total net position $ (19,724,343) $ (15,891,757) $ 146,799 $ 114,896 $ (19,577,544) $ (15,776,861)

The District has adopted GASB Statement 68, “Accounting and Financial Reporting for Pensions—an Amendment of

GASB Statement 27,” which significantly revises accounting for pension costs and liabilities. For reasons discussed

below, many end users of this financial statement will gain a clearer understanding of the District’s actual financial

condition by adding deferred inflows related to pension and the net pension liability to the reported net position and

subtracting deferred outflows related to pension.

F 8