Page 47 - Hudson City Schools CAFR 2017

P. 47

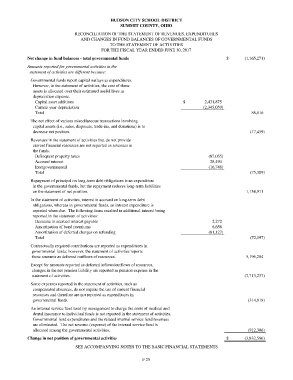

HUDSON CITY SCHOOL DISTRICT

SUMMIT COUNTY, OHIO

RECONCILIATION OF THE STATEMENT OF REVENUES, EXPENDITURES

AND CHANGES IN FUND BALANCES OF GOVERNMENTAL FUNDS

TO THE STATEMENT OF ACTIVITIES

FOR THE FISCAL YEAR ENDED JUNE 30, 2017

Net change in fund balances - total governmental funds $ (1,165,271)

Amounts reported for governmental activities in the

statement of activities are different because:

Governmental funds report capital outlays as expenditures.

However, in the statement of activities, the cost of those

assets is allocated over their estimated useful lives as

depreciation expense.

Capital asset additions $ 2,431,875

Current year depreciation (2,345,059)

Total 86,816

The net effect of various miscellaneous transactions involving

capital assets (i.e., sales, disposals, trade-ins, and donations) is to

decrease net position. (17,459)

Revenues in the statement of activities that do not provide

current financial resources are not reported as revenues in

the funds.

Delinquent property taxes (87,055)

Accrued interest 28,494

Intergovernmental (16,748)

Total (75,309)

Repayment of principal on long-term debt obligations is an expenditure

in the governmental funds, but the repayment reduces long-term liabilities

on the statement of net position. 1,154,911

In the statement of activities, interest is accrued on long-term debt

obligations, whereas in governmental funds, an interest expenditure is

reported when due. The following items resulted in additional interest being

reported in the statement of activities:

Decrease in accrued interest payable 2,272

Amortization of bond premiums 6,658

Amortization of deferred charges on refunding (81,127)

Total (72,197)

Contractually required contributions are reported as expenditures in

governmental funds; however, the statement of activities reports

these amounts as deferred outflows of resources. 5,196,284

Except for amounts reported as deferred inflows/outflows of resources,

changes in the net pension liability are reported as pension expense in the

statement of activities. (7,713,237)

Some expenses reported in the statement of activities, such as

compensated absences, do not require the use of current financial

resources and therefore are not reported as expenditures in

governmental funds. (314,818)

An internal service fund used by management to charge the costs of medical and

dental insurance to individual funds is not reported in the statement of activities.

Governmental fund expenditures and the related internal service fund revenues

are eliminated. The net revenue (expense) of the internal service fund is

allocated among the governmental activities. (912,306)

Change in net position of governmental activities $ (3,832,586)

SEE ACCOMPANYING NOTES TO THE BASIC FINANCIAL STATEMENTS

F 25