Page 44 - Hudson City Schools CAFR 2017

P. 44

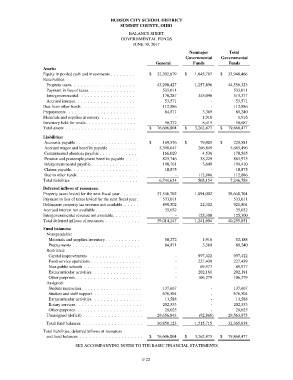

HUDSON CITY SCHOOL DISTRICT

SUMMIT COUNTY, OHIO

BALANCE SHEET

GOVERNMENTAL FUNDS

JUNE 30, 2017

Nonmajor Total

Governmental Governmental

General Funds Funds

Assets:

Equity in pooled cash and investments . . . . . . . . $ 32,302,679 $ 1,645,787 $ 33,948,466

Receivables:

Property taxes. . . . . . . . . . . . . . . . . . . . 43,298,427 1,257,896 44,556,323

Payment in lieu of taxes. . . . . . . . . . . . . . . 533,011 - 533,011

Intergovernmental. . . . . . . . . . . . . . . . . . 170,287 345,090 515,377

Accrued interest. . . . . . . . . . . . . . . . . . . 53,571 - 53,571

Due from other funds . . . . . . . . . . . . . . . . . 112,886 - 112,886

Prepayments. . . . . . . . . . . . . . . . . . . . . . 84,871 3,369 88,240

Materials and supplies inventory . . . . . . . . . . . - 1,916 1,916

Inventory held for resale. . . . . . . . . . . . . . . . 50,272 8,415 58,687

Total assets . . . . . . . . . . . . . . . . . . . . . . $ 76,606,004 $ 3,262,473 $ 79,868,477

Liabilities:

Accounts payable . . . . . . . . . . . . . . . . . . . $ 149,576 $ 79,005 $ 228,581

Accrued wages and benefits payable . . . . . . . . . 5,398,647 266,849 5,665,496

Compensated absences payable . . . . . . . . . . . . 166,029 4,536 170,565

Pension and postemployment benefits payable . . . . 825,746 38,229 863,975

Intergovernmental payable. . . . . . . . . . . . . . . 190,761 3,649 194,410

Claims payable. . . . . . . . . . . . . . . . . . . . . 10,875 - 10,875

Due to other funds . . . . . . . . . . . . . . . . . . . - 112,886 112,886

Total liabilities . . . . . . . . . . . . . . . . . . . . . 6,741,634 505,154 7,246,788

Deferred inflows of resources:

Property taxes levied for the next fiscal year . . . . . . 37,546,702 1,094,002 38,640,704

Payment in lieu of taxes levied for the next fiscal year . 533,011 - 533,011

Delinquent property tax revenue not available . . . . . 899,502 22,302 921,804

Accrued interest not available . . . . . . . . . . . . . . 35,032 - 35,032

Intergovernmental revenue not available. . . . . . . . . - 125,300 125,300

Total deferred inflows of resources . . . . . . . . . . . 39,014,247 1,241,604 40,255,851

Fund balances:

Nonspendable:

Materials and supplies inventory . . . . . . . . . . . 50,272 1,916 52,188

Prepayments . . . . . . . . . . . . . . . . . . . . . 84,871 3,369 88,240

Restricted:

Capital improvements. . . . . . . . . . . . . . . . . - 997,422 997,422

Food service operations . . . . . . . . . . . . . . . . - 227,439 227,439

Non-public schools . . . . . . . . . . . . . . . . . . - 69,977 69,977

Extracurricular activities. . . . . . . . . . . . . . . . - 202,181 202,181

Other purposes. . . . . . . . . . . . . . . . . . . . . - 106,279 106,279

Assigned:

Student instruction. . . . . . . . . . . . . . . . . . . 137,667 - 137,667

Student and staff support. . . . . . . . . . . . . . . . 676,504 - 676,504

Extracurricular activities. . . . . . . . . . . . . . . . 13,588 - 13,588

Rotary services. . . . . . . . . . . . . . . . . . . . . 202,353 - 202,353

Other purposes. . . . . . . . . . . . . . . . . . . . . 28,025 - 28,025

Unassigned (deficit) . . . . . . . . . . . . . . . . . . . 29,656,843 (92,868) 29,563,975

Total fund balances . . . . . . . . . . . . . . . . . . . 30,850,123 1,515,715 32,365,838

Total liabilities, deferred inflows of resources

and fund balances . . . . . . . . . . . . . . . . . . . . $ 76,606,004 $ 3,262,473 $ 79,868,477

SEE ACCOMPANYING NOTES TO THE BASIC FINANCIAL STATEMENTS

F 22