Page 93 - Hudson City Schools CAFR 2017

P. 93

HUDSON CITY SCHOOL DISTRICT

SUMMIT COUNTY, OHIO

NOTES TO THE BASIC FINANCIAL STATEMENTS

FOR THE FISCAL YEAR ENDED JUNE 30, 2017

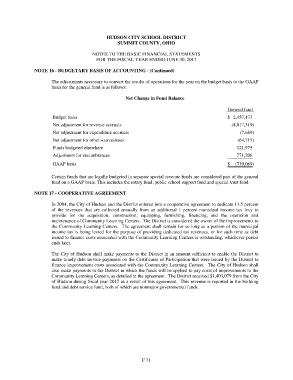

NOTE 16 - BUDGETARY BASIS OF ACCOUNTING - (Continued)

The adjustments necessary to convert the results of operations for the year on the budget basis to the GAAP

basis for the general fund is as follows:

Net Change in Fund Balance

General fund

Budget basis $ 2,457,473

Net adjustment for revenue accruals (4,017,319)

Net adjustment for expenditure accruals (7,689)

Net adjustment for other sources/uses (64,715)

Funds budgeted elsewhere 121,975

Adjustment for encumbrances 771,206

GAAP basis $ (739,069)

Certain funds that are legally budgeted in separate special revenue funds are considered part of the general

fund on a GAAP basis. This includes the rotary fund, public school support fund and special trust fund.

NOTE 17 - COOPERATIVE AGREEMENT

In 2004, the City of Hudson and the District entered into a cooperative agreement to dedicate 13.5 percent

of the revenues that are collected annually from an additional 1 percent municipal income tax levy to

provide for the acquisition, construction, equipping, furnishing, financing, and the operation and

maintenance of Community Learning Centers. The District is considered the owner of the improvements to

the Community Learning Centers. The agreement shall remain for so long as a portion of the municipal

income tax is being levied for the purpose of providing dedicated tax revenues, or for such time as debt

issued to finance costs associated with the Community Learning Centers is outstanding, whichever period

ends later.

The City of Hudson shall make payments to the District in an amount sufficient to enable the District to

make timely debt service payments on the Certificates of Participation that were issued by the District to

finance improvement costs associated with the Community Learning Centers. The City of Hudson shall

also make payments to the District in which the funds will be applied to pay costs of improvements to the

Community Learning Centers, as detailed in the agreement. The District received $1,403,079 from the City

of Hudson during fiscal year 2017 as a result of this agreement. This revenue is reported in the building

fund and debt service fund, both of which are nonmajor governmental funds.

F 71