Page 94 - Hudson City Schools CAFR 2017

P. 94

HUDSON CITY SCHOOL DISTRICT

SUMMIT COUNTY, OHIO

NOTES TO THE BASIC FINANCIAL STATEMENTS

FOR THE FISCAL YEAR ENDED JUNE 30, 2017

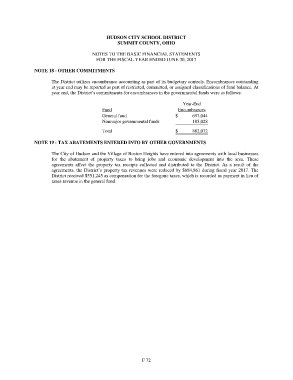

NOTE 18 - OTHER COMMITMENTS

The District utilizes encumbrance accounting as part of its budgetary controls. Encumbrances outstanding

at year end may be reported as part of restricted, committed, or assigned classifications of fund balance. At

year end, the District’s commitments for encumbrances in the governmental funds were as follows:

Year-End

Fund Encumbrances

General fund $ 697,044

Nonmajor governmental funds 185,028

Total $ 882,072

NOTE 19 - TAX ABATEMENTS ENTERED INTO BY OTHER GOVERNMENTS

The City of Hudson and the Village of Boston Heights have entered into agreements with local businesses

for the abatement of property taxes to bring jobs and economic development into the area. These

agreements affect the property tax receipts collected and distributed to the District. As a result of the

agreements, the District’s property tax revenues were reduced by $684,861 during fiscal year 2017. The

District received $551,245 as compensation for the foregone taxes, which is recorded as payment in lieu of

taxes revenue in the general fund.

F 72