Page 67 - buku teknologi digital

P. 67

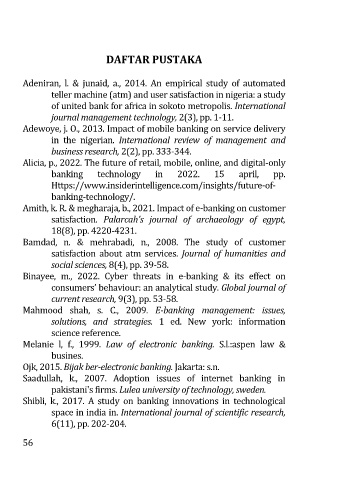

DAFTAR PUSTAKA

Adeniran, l. & junaid, a., 2014. An empirical study of automated

teller machine (atm) and user satisfaction in nigeria: a study

of united bank for africa in sokoto metropolis. International

journal management technology, 2(3), pp. 1-11.

Adewoye, j. O., 2013. Impact of mobile banking on service delivery

in the nigerian. International review of management and

business research, 2(2), pp. 333-344.

Alicia, p., 2022. The future of retail, mobile, online, and digital-only

banking technology in 2022. 15 april, pp.

Https://www.insiderintelligence.com/insights/future-of-

banking-technology/.

Amith, k. R. & megharaja, b., 2021. Impact of e-banking on customer

satisfaction. Palarcah's journal of archaeology of egypt,

18(8), pp. 4220-4231.

Bamdad, n. & mehrabadi, n., 2008. The study of customer

satisfaction about atm services. Journal of humanities and

social sciences, 8(4), pp. 39-58.

Binayee, m., 2022. Cyber threats in e-banking & its effect on

consumers’ behaviour: an analytical study. Global journal of

current research, 9(3), pp. 53-58.

Mahmood shah, s. C., 2009. E-banking management: issues,

solutions, and strategies. 1 ed. New york: information

science reference.

Melanie l, f., 1999. Law of electronic banking. S.l.:aspen law &

busines.

Ojk, 2015. Bijak ber-electronic banking. Jakarta: s.n.

Saadullah, k., 2007. Adoption issues of internet banking in

pakistani's firms. Lulea university of technology, sweden.

Shibli, k., 2017. A study on banking innovations in technological

space in india in. International journal of scientific research,

6(11), pp. 202-204.

56