Page 28 - MCCU

P. 28

MANCHESTER CO-OPERATIVE CREDIT UNION (1977) LTD.

Investments and Cash Reserves

The cash and investment portfolio closed the year

at $1.85 billion. This represented an increase of 7%

over 2016 and accounted for 37% of total assets.

The Credit Union earned an average of 5.6% on

investments during the year. This was below the

5.8% achieved in 2016.

The Credit Union maintained adequate liquidity

reserves during the year and was always able to

meet the day-to-day cash flow requirements. These

reserves were held in interest bearing accounts at

the Credit Union Fund Management Company.

Savings

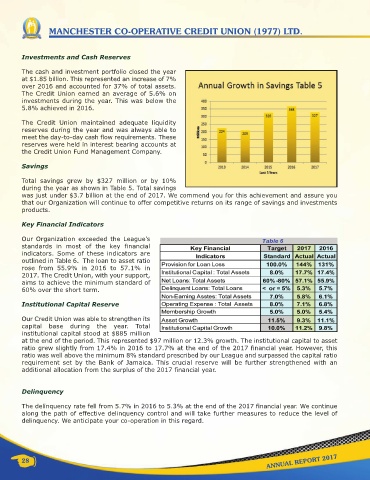

Total savings grew by $327 million or by 10%

during the year as shown in Table 5. Total savings

was just under $3.7 billion at the end of 2017. We commend you for this achievement and assure you

that our Organization will continue to offer competitive returns on its range of savings and investments

products.

Key Financial Indicators

Our Organization exceeded the League’s

standards in most of the key financial

indicators. Some of these indicators are

outlined in Table 6. The loan to asset ratio

rose from 55.9% in 2016 to 57.1% in

2017. The Credit Union, with your support,

aims to achieve the minimum standard of

60% over the short term.

Institutional Capital Reserve

Our Credit Union was able to strengthen its

capital base during the year. Total

institutional capital stood at $885 million

at the end of the period. This represented $97 million or 12.3% growth. The institutional capital to asset

ratio grew slightly from 17.4% in 2016 to 17.7% at the end of the 2017 financial year. However, this

ratio was well above the minimum 8% standard prescribed by our League and surpassed the capital ratio

requirement set by the Bank of Jamaica. This crucial reserve will be further strengthened with an

additional allocation from the surplus of the 2017 financial year.

Delinquency

The delinquency rate fell from 5.7% in 2016 to 5.3% at the end of the 2017 financial year. We continue

along the path of effective delinquency control and will take further measures to reduce the level of

delinquency. We anticipate your co-operation in this regard.

*

28 ANNUAL REPORT 2017