Page 26 - Flats on 12 OM - draft

P. 26

Flats on 12

R

I

O

D

S

I

E

P PRESIDIO

7

8

7

I

0

F

X

0

1

D

E

5

H

B

3 3150 FINFEATHER ROAD BRYAN, TX 77801 1

F

T

O

A

R

R

N

Y

T

A

R

N

E

,

A

Y

A

M

A

S SUBMARKET T B BRYAN N

B

R

E

K

R

U

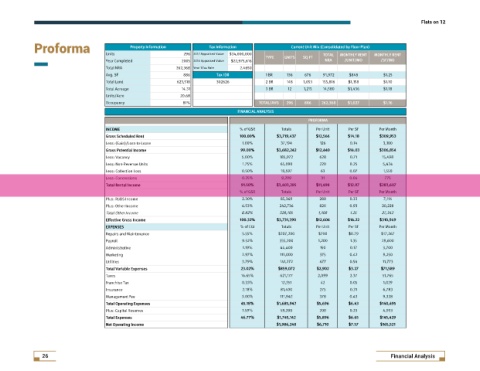

Proforma P Property Information n T Tax Information n C Current Unit Mix (Consolidated by Floor Plan) )

r

i

t

t

o

f

u

r

o

a

r

m

y

I

n

I

m

n

o

r

f

o

a

x

a

i

t

F

n

r

s

p

P

r

C

o

l

d

e

t

b

y

l

o

o

a

d

i

n

o

e

o

t

i

n

e

r

U

t

n

x

a

(

M

l

i

Units 296 2017 Appraised Value $24,000,000 T TOTAL L M MONTHLY RENT T M MONTHLY RENT T

Y

L

T

H

L

N

R

H

E

N

N

O

T

N

E

O

A

R

O

Y

T

N

I

Y

P

F

T

Q

T TYPE E U UNITS S S SQ FT T

N

I

R

U

/

/

T

M

M

S

F

Year Completed 2005 2016 Appraised Value $22,975,616 N NRA A / /UNIT/MO O / /SF/MO O

Total NRA 262,368 Year 1 Tax Rate 2.4650

a

x

I

D

Avg. SF 886 T Tax ID# # 1 BR 136 676 91,972 $848 $1.25

Total Land 623,518 302626 2 BR 148 1,053 155,816 $1,158 $1.10

Total Acreage 14.31 3 BR 12 1,215 14,580 $1,436 $1.18

Units/Acre 20.68

2

0

9

/

,

,

6

3

1

L

1

8

6

1

A

T

2

V

O

.

A

Occupancy 81% T TOTAL/AVG G 2 296 6 8 886 6 2 262,368 8 $ $1,027 7 $ $1.16 6

S

F FINANCIAL ANALYSIS S

A

Y

A

L

N

L

A

A

I

C

N

I

N

I

F

O

P PROFORMA A

R

O

R

M

M

N

I INCOME E % of GSR Totals Per Unit Per SF Per Month

O

C

,

,

3

0

1

9

3

,

4

7

0

0

4

1

0

9

1

.

.

9

0

,

%

2

3

1

5

6

5

c

S

n

o

s

d

s

R

u

e

r

d

e

e

l

G Gross Scheduled Rent t 1 100.00% $ $3,719,437 7 $ $12,566 6 $ $14.18 8 $ $309,953 3

h

Less: (Gain)/Loss-to-Lease 1.00% 37,194 126 0.14 3,100

5

4

0

4

8

0

0

1

.

8

2

,

6

3

,

0

3

,

4

%

2

2

4

1

,

.

9

6

n

P

s

l

n

I

i

t

G Gross Potential Income e 9 99.00% $ $3,682,242 2 $ $12,440 0 $ $14.03 3 $ $306,854 4

s

o

e

r

t

m

c

o

o

a

Less: Vacancy 5.00% 185,972 628 0.71 15,498

Less: Non-Revenue Units 1.75% 65,090 220 0.25 5,424

Less: Collection Loss 0.50% 18,597 63 0.07 1,550

Less: Concessions 0.25% 9,299 31 0.04 775

T Total Rental Income e 9 91.50% $ $3,403,285 5 $ $11,498 8 $ $12.97 7 $ $283,607 7

0

1

1

,

,

t

,

4

3

m

l

6

a

8

I

9

o

l

2

,

3

a

t

4

0

1

2

n

0

2

3

n

.

1

%

c

o

8

5

R

.

9

e

% of GSR Totals Per Unit Per SF Per Month

Plus: RUBS Income 2.30% 85,369 288 0.33 7,114

Plus: Other Income 6.53% 242,736 820 0.93 20,228

Total Other Income 8.82% 328,105 1,108 1.25 27,342

1

3

9

%

0

0

2

0

2

3

,

2

.

.

6

4

1

,

0

4

7

3

,

3

3

,

1

9

1

G

e

I

o

c

o

f

s

m

e

s

t

c

f

r

v

i

n

E Effective Gross Income e 1 100.32% $ $3,731,390 0 $ $12,606 6 $ $14.22 2 $ $310,949 9

S

E

N

E

X

P

E EXPENSES S % of EGI Totals Per Unit Per SF Per Month

Repairs and Maintenance 5.55% $207,200 $700 $0.79 $17,267

Payroll 9.52% 355,200 1,200 1.35 29,600

Administrative 1.19% 44,400 150 0.17 3,700

Marketing 2.97% 111,000 375 0.42 9,250

Utilities 3.79% 141,272 477 0.54 11,773

x

l

.

T Total Variable Expenses s 2 23.02% $ $859,072 2 $ $2,902 2 $ $3.27 7 $ $71,589 9

3

,

E

0

o

2

e

e

p

9

a

b

7

e

V

%

l

8

r

i

9

7

5

a

8

5

,

0

3

n

a

1

t

2

s

.

0

2

,

Taxes 16.65% 621,177 2,099 2.37 51,765

Franchise Tax 0.33% 12,351 42 0.05 1,029

Insurance 2.18% 81,400 275 0.31 6,783

Management Fee 3.00% 111,942 378 0.43 9,328

e

4

g

.

6

n

.

%

6

O

,

p

1

4

,

1

8

5

4

6

9

i

4

,

5

n

9

e

t

t

a

o

x

l

r

,

a

p

8

5

1

0

E

s

9

e

T Total Operating Expenses s 4 45.18% $ $1,685,942 2 $ $5,696 6 $ $6.43 3 $ $140,495 5

Plus: Capital Reserves 1.59% 59,200 200 0.23 4,933

2

4

1

5

,

4

E

7

,

1

x

5

,

l

4

e

p

n

e

s

7

%

7

6

.

8

t

,

.

o

6

9

5

6

4

T Total Expenses s 4 46.77% $ $1,745,142 2 $ $5,896 6 $ $6.65 5 $ $145,429 9

1

a

r

N Net Operating Income e $ $1,986,248 8 $ $6,710 0 $ $7.57 7 $ $165,521 1

i

n

t

a

p

O

5

t

2

e

e

,

,

2

4

8

1

6

6

7

.

5

,

7

1

9

I

n

c

g

5

6

1

,

m

o

ARA Newmark ♦ 1700 Post Oak Blvd, 2 BLVD Place, Suite 400 ♦ Houston, Texas 77056 ♦ T 713.599.1800 ♦ F 713.599.1801 ♦ www.aranewmark.com

This information has been derived from sources deemed reliable. However, it is subject to errors, omissions, price change and/or withdrawal, and no warranty is made as to the

accuracy. Further, no warranties or representation shall be made by ARA Newmark and/or its agents, representatives or affiliates regarding oral statements which have been

Financial Analysis

26 made in the discussion of the above property. This presentation, prepared by ARA Newmark, was sent to the recipient under the assumption that s/ he is a buying principal. Any

potential purchaser is advised that s/ he should either have the abstract covering the real estate which is the subject of the contract examined by an attorney of his/her selection,

or be furnished a policy of title insurance.

www.aranewmark.com