Page 27 - Flats on 12 OM - draft

P. 27

Newmark Knight Frank

Underwriting Assumptions

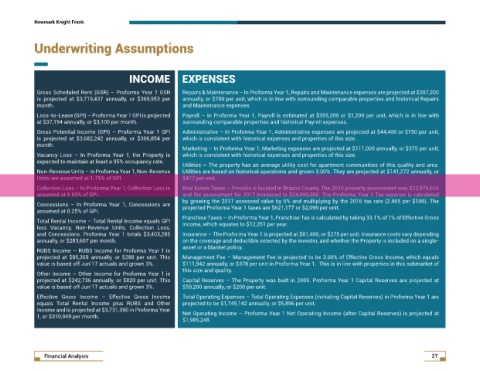

INCOME EXPENSES

Gross Scheduled Rent (GSR) – Proforma Year 1 GSR Repairs & Maintenance – In Proforma Year 1, Repairs and Maintenance expenses are projected at $207,200

is projected at $3,719,437 annually, or $309,953 per annually, or $700 per unit, which is in line with surrounding comparable properties and historical Repairs

month. and Maintenance expenses.

Loss-to-Lease (GPI) – Proforma Year 1 GPI is projected Payroll – In Proforma Year 1, Payroll is estimated at $355,200 or $1,200 per unit, which is in line with

at $37,194 annually, or $3,100 per month. surrounding comparable properties and historical Payroll expenses.

Gross Potential Income (GPI) – Proforma Year 1 GPI Administrative – In Proforma Year 1, Administrative expenses are projected at $44,400 or $150 per unit,

is projected at $3,682,242 annually, or $306,854 per which is consistent with historical expenses and properties of this size.

month.

Marketing – In Proforma Year 1, Marketing expenses are projected at $111,000 annually, or $375 per unit,

Vacancy Loss – In Proforma Year 1, the Property is which is consistent with historical expenses and properties of this size.

expected to maintain at least a 95% occupancy rate.

Utilities – The property has an average utility cost for apartment communities of this quality and area.

Non-Revenue Units – In Proforma Year 1, Non-Revenue Utilities are based on historical operations and grown 3.00%. They are projected at $141,272 annually, or

Units are assumed at 1.75% of GPI. $477 per unit.

Collection Loss – In Proforma Year 1, Collection Loss is Real Estate Taxes – Presidio is located in Brazos County. The 2016 property assessment was $22,975,616

assumed at 0.50% of GPI. and the assessment for 2017 increased to $24,000,000. The Proforma Year 1 Tax expense is calculated

by growing the 2017 assessed value by 5% and multiplying by the 2016 tax rate (2.465 per $100). The

Concessions – In Proforma Year 1, Concessions are projected Proforma Year 1 taxes are $621,177 or $2,099 per unit.

assumed at 0.25% of GPI.

Franchise Taxes – In Proforma Year 1, Franchise Tax is calculated by taking 33.1% of 1% of Effective Gross

Total Rental Income – Total Rental Income equals GPI Income, which equates to $12,351 per year.

less Vacancy, Non-Revenue Units, Collection Loss,

and Concessions. Proforma Year 1 totals $3,403,285 Insurance – The Proforma Year 1 is projected at $81,400, or $275 per unit. Insurance costs vary depending

annually, or $283,607 per month. on the coverage and deductible selected by the investor, and whether the Property is included on a single-

asset or a blanket policy.

RUBS Income – RUBS Income for Proforma Year 1 is

projected at $85,369 annually, or $288 per unit. This Management Fee – Management Fee is projected to be 3.00% of Effective Gross Income, which equals

value is based off Jun’17 actuals and grown 3%. $111,942 annually, or $378 per unit in Proforma Year 1. This is in line with properties in this submarket of

this size and quality.

Other Income – Other Income for Proforma Year 1 is

projected at $242,736 annually, or $820 per unit. This Capital Reserves – The Property was built in 2005. Proforma Year 1 Capital Reserves are projected at

value is based off Jun’17 actuals and grown 3%. $59,200 annually, or $200 per unit.

Effective Gross Income – Effective Gross Income Total Operating Expenses – Total Operating Expenses (including Capital Reserves) in Proforma Year 1 are

equals Total Rental Income plus RUBS and Other projected to be $1,745,142 annually, or $5,896 per unit.

Income and is projected at $3,731,390 in Proforma Year

1, or $310,949 per month. Net Operating Income – Proforma Year 1 Net Operating Income (after Capital Reserves) is projected at

$1,986,248.

Financial Analysis 27