Page 18 - Bullion World Issue 11 March 2022_Neat

P. 18

Bullion World | Issue 11 | March 2022

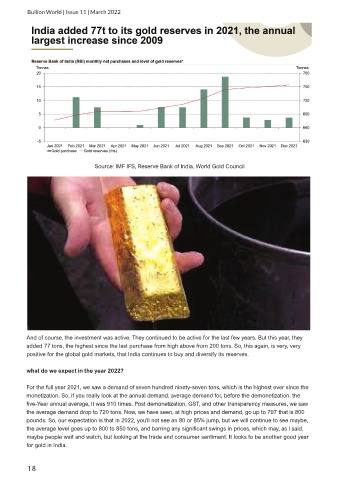

Source: IMF IFS, Reserve Bank of India, World Gold Council

And of course, the investment was active. They continued to be active for the last few years. But this year, they

added 77 tons, the highest since the last purchase from high above from 200 tons. So, this again, is very, very

positive for the global gold markets, that India continues to buy and diversify its reserves.

what do we expect in the year 2022?

For the full year 2021, we saw a demand of seven hundred ninety-seven tons, which is the highest ever since the

monetization. So, if you really look at the annual demand, average demand for, before the demonetization, the

five-Year annual average, it was 910 times. Post demonetization, GST, and other transparency measures, we saw

the average demand drop to 720 tons. Now, we have seen, at high prices and demand, go up to 797 that is 800

pounds. So, our expectation is that in 2022, you'll not see an 80 or 85% jump, but we will continue to see maybe,

the average level goes up to 800 to 850 tons, and barring any significant swings in prices, which may, as I said,

maybe people wait and watch, but looking at the trade and consumer sentiment. It looks to be another good year

for gold in India.

18