Page 51 - Managerial Accounting-MGT 145

P. 51

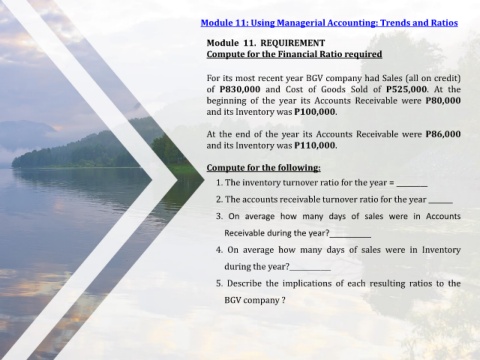

Module 11: Using Managerial Accounting: Trends and Ratios

Module 11. REQUIREMENT

Compute for the Financial Ratio required

For its most recent year BGV company had Sales (all on credit)

of P830,000 and Cost of Goods Sold of P525,000. At the

beginning of the year its Accounts Receivable were P80,000

and its Inventory was P100,000.

At the end of the year its Accounts Receivable were P86,000

and its Inventory was P110,000.

Compute for the following:

1. The inventory turnover ratio for the year = _________

2. The accounts receivable turnover ratio for the year _______

3. On average how many days of sales were in Accounts

Receivable during the year?_________

4. On average how many days of sales were in Inventory

during the year?____________

5. Describe the implications of each resulting ratios to the

BGV company ?