Page 55 - Managerial Accounting-MGT 145

P. 55

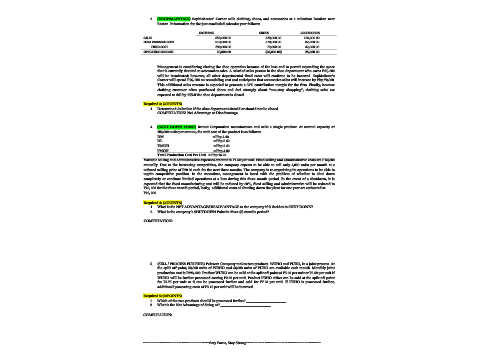

3. (DROP/MAINTAIN) Sophisticates’ Corner sells clothing, shoes, and accessories at a suburban location near

Boston. Information for the just concluded calendar year follows:

CLOTHING SHOES ACCESSORIES

SALES 850,000.00 320,000.00 150,000.00

LESS: VARIABLE COST 510,000.00 270,000.00 82,500.00

FIXED COST 290,000.00 70,000.00 42,000.00

OPERATING INCOME 50,000.00 (20,000.00) 25,500.00

Management is considering closing the shoe operation because of the loss and to permit expanding the space

that is currently devoted to accessories sales. A salaried sales person in the shoe department who earns P45, 000

will be terminated; however, all other departmental fixed costs will continue to be incurred. Sophisticate’s

Corner will spend P16, 000 on remodeling cost and anticipates that accessories sales will increase by Php 70,000.

This additional sales revenue is expected to generate a 35% contribution margin for the firm. Finally, because

clothing customer often purchased shoes and feel strongly about “one-stop shopping”, clothing sales are

expected to fall by 15%if the shoe department is closed.

Required 3: (20POINTS)

1. Determined /calculate if the shoe department should or should not be closed.

COMPUTATION: Net Advantage or Disadvantage

4. (SHUT DOWN POINT) Brunei Corporation manufactures and sells a single product. At normal capacity of

100,000 units per annum, the unit cost of the product is as follows:

DM = Php 4.40

DL = Php 5.60

VMOH = Php 2.40

FMOH = Php 4.00

Total Production Cost Per Unit = Php 16.40

Variable selling and administrative expenses amount to P1.60 per unit. Fixed selling and administrative costs are P 80,000

annually. Due to the increasing competition, the company expects to be able to sell only 4,000 units per month at a

reduced selling price of P20.00 each for the next three months. The company is re-organizing its operations to be able to

regain competitive position. In the meantime, management is faced with the problem of whether to shut down

completely or continue limited operations at a loss during this three month period. In the event of a shutdown, it is

expected that the fixed manufacturing cost will be reduced by 60%, fixed selling and administrative will be reduced to

P10, 000 for the three month period, lastly, additional costs of shutting down the plant for one year are estimated at

P10, 000.

Required 4: (20POINTS)

1. What is the NET ADVANTAGE/DISADVANTAGE to the company if it decides to SHUT DOWN?

2. What is the company’s SHUTDOWN Point in three (3) months period?

COMPUTATION:

5. (SELL / PROCESS FURTHER) Palawan Company makes two products. WUHO and PUHO, in a joint process. At

the split off point, 50,000 units of WUHO and 60,000 units of PUHO are available each month. Monthly joint

production cost is P290, 000. Product WUHO can be sold at the split off point at P5.60 per unit or P8.30 per unit if

WUHO will be further processed costing P2.50 per unit. Product PUHO either can be sold at the split off point

for P4.75 per unit or it can be processed further and sold for P7.20 per unit. If PUHO is processed further,

additional processing costs of P3.10 per unit will be incurred.

Required 5: (20POINTS)

1. Which of the two products should be processed further? _______________________

2. What is the Net Advantage of doing so? _____________________________

COMPUTATION:

*******************************************Stay Focus, Stay Strong*************************************************

************** STAY FOCUS MOVE FORWARD **********