Page 54 - Managerial Accounting-MGT 145

P. 54

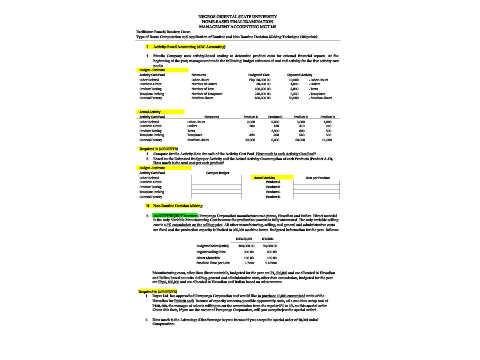

NEGROS ORIENTAL STATE UNIVERSITY

HOME-BASED FINAL EXAMINATION

MANAGEMENT ACCOUNTING MGT 145

Facilitator: Pamela Ramirez Cueco

Type of Exam: Computation and Application of Routine and Non Routine Decision Making Technique (100points)

I. Activity-Based Accounting (ABC Accounting)

1. Manila Company uses activity-based costing to determine product costs for external financial reports. At the

beginning of the year, management made the following Budget estimates of cost and activity for the five activity cost

pools:

Budget - Estimate

Activity Cost Pool Measures Budgeted Cost Expected Activity

Labor Related Labor-Hours Php. 50,000.00 10,000 =Labor-Hours

Purchase Order Number of Orders 30,000.00 1,000 =Orders

Product Testing Number of Test 100,000.00 4,000 =Tests

Template Etching Number of Templates 240,000.00 2,400 =Templates

General Factory Machine-Hours 400,000.00 50,000 =Machine-Hours

Actual Activity

Activity Cost Pool Measures Product A Product B Product C Product D

Labor Related Labor-Hours 2,000 5,000 3,000 1,000

Purchase Order Orders 200 130 410 210

Product Testing Tests - 2,900 800 500

Template Etching Templates 490 400 560 550

General Factory Machine-Hours 12,000 6,000 18,900 11,000

Required 1: (20POINTS)

1. Compute for the Activity-Rate for each of the Activity Cost Pool. How much is each Activity Cost Pool?

2. Based on the Estimated Budget per Activity and the Actual Activity Consumption of each Products (Product A-D),

How much is the total cost per each product?

Budget - Estimate

Activity Cost Pool Cost per Budget

Labor Related Actual Activity Cost per Product

Purchase Order Product A

Product Testing Product B

Template Etching Product C

General Factory Product D

II. Non-Routine Decision Making

2. (ACCEPT/REJECT Decision) Pampanga Corporation manufactures two pizzas, Hawaiian and Italian. Direct material

is the only Variable Manufacturing Cost because the production process is fully automated. The only variable selling

cost is a 5% commission on the selling price. All other manufacturing, selling, and general and administrative costs

are fixed and the production capacity is limited to 235,000 machine hours. Budgeted information for the year follows:

HAWAIIAN ITALIAN

Budgeted Sales (units) 100,000.00 90,000.00

Regular Selling Price 300.00 450.00

Direct Materials 100.00 160.00

Machine Time per Unit 1 hour 1.4 hour

Manufacturing costs, other than direct materials, budgeted for the year are P1, 590,000 and are allocated to Hawaiian

and Italian based on units. Selling, general and administrative costs, other than commission, budgeted for the year

are Php3, 895,000 and are allocated to Hawaiian and Italian based on sales revenue.

Required 2: (20POINTS)

1. Buyer Ltd. has approached Pampanga Corporation and would like to purchase 10,000 customized units of the

Hawaiian for P240.00 each. Because of capacity concerns, possible opportunity costs, ad a one-time setup cost of

P100, 000, the manager of sales is willing to cut the commission from the regular 5% to 3% on this special order.

Given this facts, if you are the owner of Pampanga Corporation, will you accept/reject the special order?

2. How much is the Advantage /Disadvantage to your Income if you accept the special order of 10,000 units?

Computation: