Page 288 - B2B All Year Round Vol.8

P. 288

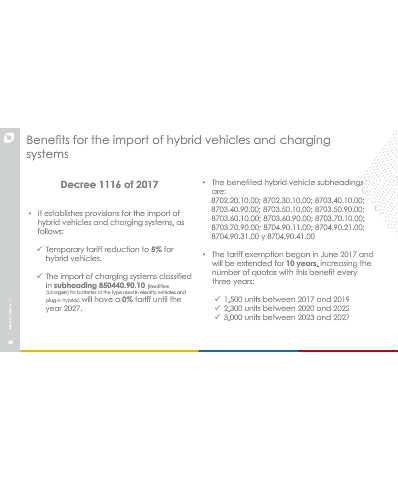

Benefits for the import of hybrid vehicles and charging

systems

Decree 1116 of 2017 • The benefited hybrid vehicle subheadings

are:

8702.20.10.00; 8702.30.10.00; 8703.40.10.00;

• It establishes provisions for the import of 8703.40.90.00; 8703.50.10.00; 8703.50.90.00;

hybrid vehicles and charging systems, as 8703.60.10.00; 8703.60.90.00; 8703.70.10.00;

follows: 8703.70.90.00; 8704.90.11.00; 8704.90.21.00;

8704.90.31.00 y 8704.90.41.00

Temporary tariff reduction to 5% for

hybrid vehicles. • The tariff exemption began in June 2017 and

will be extended for 10 years, increasing the

The import of charging systems classified number of quotas with this benefit every

three years:

in subheading 850440.90.10 (Rectifiers

(chargers) for batteries of the type used in electric vehicles and

plug-in hybrids) will have a 0% tariff until the 1,500 units between 2017 and 2019

year 2027. 2,300 units between 2020 and 2022

3,000 units between 2023 and 2027

39