Page 51 - The Insurance Times August 2025

P. 51

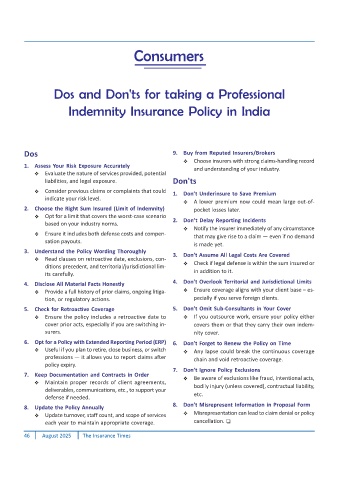

Consumers

Dos and Don'ts for taking a Professional

Indemnity Insurance Policy in India

Dos 9. Buy from Reputed Insurers/Brokers

Choose insurers with strong claims-handling record

1. Assess Your Risk Exposure Accurately and understanding of your industry.

Evaluate the nature of services provided, potential

liabilities, and legal exposure. Don'ts

Consider previous claims or complaints that could

1. Dont Underinsure to Save Premium

indicate your risk level.

A lower premium now could mean large out-of-

2. Choose the Right Sum Insured (Limit of Indemnity) pocket losses later.

Opt for a limit that covers the worst-case scenario

2. Dont Delay Reporting Incidents

based on your industry norms.

Notify the insurer immediately of any circumstance

Ensure it includes both defense costs and compen-

that may give rise to a claim even if no demand

sation payouts.

is made yet.

3. Understand the Policy Wording Thoroughly

3. Dont Assume All Legal Costs Are Covered

Read clauses on retroactive date, exclusions, con-

Check if legal defense is within the sum insured or

ditions precedent, and territorial/jurisdictional lim-

its carefully. in addition to it.

4. Disclose All Material Facts Honestly 4. Dont Overlook Territorial and Jurisdictional Limits

Provide a full history of prior claims, ongoing litiga- Ensure coverage aligns with your client base es-

tion, or regulatory actions. pecially if you serve foreign clients.

5. Check for Retroactive Coverage 5. Dont Omit Sub-Consultants in Your Cover

Ensure the policy includes a retroactive date to If you outsource work, ensure your policy either

cover prior acts, especially if you are switching in- covers them or that they carry their own indem-

surers. nity cover.

6. Opt for a Policy with Extended Reporting Period (ERP) 6. Dont Forget to Renew the Policy on Time

Useful if you plan to retire, close business, or switch Any lapse could break the continuous coverage

professions it allows you to report claims after

chain and void retroactive coverage.

policy expiry.

7. Dont Ignore Policy Exclusions

7. Keep Documentation and Contracts in Order

Be aware of exclusions like fraud, intentional acts,

Maintain proper records of client agreements, bodily injury (unless covered), contractual liability,

deliverables, communications, etc., to support your

defense if needed. etc.

8. Dont Misrepresent Information in Proposal Form

8. Update the Policy Annually

Update turnover, staff count, and scope of services Misrepresentation can lead to claim denial or policy

each year to maintain appropriate coverage. cancellation.

46 August 2025 The Insurance Times