Page 19 - Life Insurance Today April 2018

P. 19

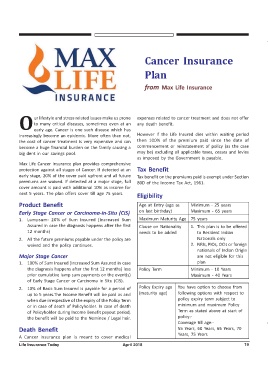

Cancer Insurance

Plan

from Max Life Insurance

O ur lifestyle and stress related issues make us prone expenses related to cancer treatment and does not offer

to many critical diseases, sometimes even at an

any death benefit.

early age. Cancer is one such disease which has

increasingly become an epidemic. More often than not, However if the Life Insured dies within waiting period

the cost of cancer treatment is very expensive and can then 100% of the premium paid since the date of

become a huge financial burden on the family causing a commencement or reinstatement of policy (as the case

big dent in our savings pool. may be) excluding all applicable taxes, cesses and levies

as imposed by the Government is payable.

Max Life Cancer Insurance plan provides comprehensive

protection against all stages of Cancer. If detected at an Tax Benefit

early stage, 20% of the cover paid upfront and all future Tax benefit on the premiums paid is exempt under Section

premiums are waived. If detected at a major stage, full 80D of the Income Tax Act, 1961.

cover amount is paid with additional 10% as income for

next 5 years. The plan offers cover till age 75 years.

Eligibility

Product Benefit Age at Entry (age as Minimum - 25 years

Early Stage Cancer or Carcinoma-in-Situ (CiS) on last birthday) Maximum - 65 years

1. Lumpsum- 20% of Sum Insured (Increased Sum Maximum Maturity Age 75 years

Assured in case the diagnosis happens after the first Clause on Nationality 1. This plan is to be offered

12 months) needs to be added to Resident Indian

2. All the future premiums payable under the policy are Nationals only

waived and the policy continues. 2. NRIs, PIOs, OCIs or foreign

nationals of Indian Origin

Major Stage Cancer are not eligible for this

1. 100% of Sum Insured (Increased Sum Assured in case plan

the diagnosis happens after the first 12 months) less Policy Term Minimum - 10 Years

prior cumulative lump sum payments on the event(s) Maximum - 40 Years

of Early Stage Cancer or Carcinoma in Situ (CiS).

2. 10% of Basic Sum Insured is payable for a period of Policy Expiry age You have option to choose from

up to 5 years.The Income Benefit will be paid as and (maturity age) following options with respect to

when due irrespective of the expiry of the Policy Term policy expiry term subject to

or in case of death of Policyholder. In case of death minimum and maximum Policy

of Policyholder during Income Benefit payout period, Term as stated above at start of

the benefit will be paid to the Nominee / Legal heir. policy:-

Coverage till age:-

Death Benefit 55 Years, 60 Years, 65 Years, 70

Years, 75 Years

A Cancer insurance plan is meant to cover medical

Life Insurance Today April 2018 19