Page 20 - Life Insurance Today April 2018

P. 20

Policy Term = opted policy expiry applicable from the date of

age less Entry Age. commencement or reinstatement of

Sum Insured Minimum: Rs. 10 Lakhs Maximum: cover whichever is later. For

Rs. 50 Lakhs reinstatement cases, Waiting Period

Please note that the Sum Insured is only applicable if reinstatement

can be chosen only in intervals of happens post 90 days of date of last

Rs. 5 Lakhs. unpaid premium i.e. if the policy is

revived within 90 days from date of

The product offers an inbuilt-

last unpaid premium than no

indexation benefit, where in the

Waiting Period is applicable. If Life

Sum Insured under the product

Insured is diagnosed with CiS or

increases by 10% (simple rate) on

Early Stage Cancer or Major Stage

each policy anniversary till the time

Cancer or dies during the Waiting

no claim has been admitted in the

Period, then no benefit is payable

past; up to a maximum of 150% of

apart from refund of 100% of the

the Basic Sum Insured at the start premium paid since the date of

of the Policy.

commencement or reinstatement of

Maximum Sum Insured under this

policy (as the case may be)

plan will be Rs. 75 Lakhs after

excluding all applicable taxes, cesses

allowing in built indexation benefit

and levies asimposed by the

(subject to no claim during Government along with any other

indexation period). cess and late fee and / or interest

Waiting Period 180 Days waiting period is payment paid on reinstatement.

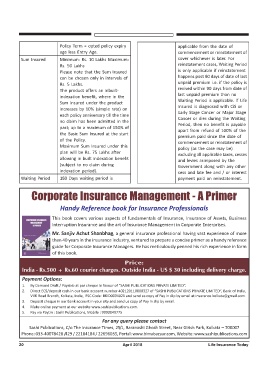

Corporate Insurance Management - A Primer

Handy Reference book for Insurance Professionals

This book covers various aspects of fundamentals of Insurance, Insurance of Assets, Business

Interruption Insurance and the art of Insurance Management in Corporate Enterprises.

Mr. Sanjiv Achut Shanbhag, a general insurance professional having vast experience of more

than 40 years in the insurance industry, ventured to prepare a concise primer as a handy reference

guide for Corporate Insurance Managers. He has meticulously penned his rich experience in form

of this book.

Price:

India - Rs.500 + Rs.60 courier charges. Outside India - US $ 30 including delivery charge.

Payment Options:

1. By Demand Draft / Payable at par cheque in favour of “SASHI PUBLICATIONS PRIVATE LIMITED”.

2. Direct ECS/deposit cash in our bank account number 402120110000327 of “SASHI PUBLICATIONS PRIVATE LIMITED”, Bank of India,

VVK Road Branch, Kolkata, India, IFSC Code: BKID0004021 and send us copy of Pay in slip by email at insurance.kolkata@gmail.com.

3. Deposit cheque in our bank account in your city and send us copy of Pay in slip by email.

4. Make online payment at our website www.sashipublications.com.

5. Pay via Paytm : Sashi Publications, Mobile : 9903040775

For any query please contact

Sashi Publications, C/o The Insurance Times, 25/1, Baranashi Ghosh Street, Near Girish Park, Kolkata – 700007

Phone: 033-40078428 /429 / 22184184 / 22696035, Portal: www.bimabazaar.com, Website: www.sashipublications.com

20 April 2018 Life Insurance Today