Page 31 - Life Insurance Today January-June 2020

P. 31

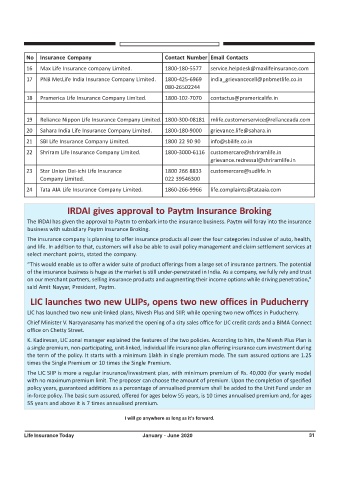

No Insurance Company Contact Number Email Contacts

16 Max Life Insurance company Limited. 1800-180-5577 service.helpdesk@maxlifeinsurance.com

17 PNB MetLife India Insurance Company Limited. 1800-425-6969 india_grievancecell@pnbmetlife.co.in

080-26502244

18 Pramerica Life Insurance Company Limited. 1800-102-7070 contactus@pramericalife.in

19 Reliance Nippon Life Insurance Company Limited. 1800-300-08181 rnlife.customerservice@relianceada.com

20 Sahara India Life Insurance Company Limited. 1800-180-9000 grievance.life@sahara.in

21 SBI Life Insurance Company Limited. 1800 22 90 90 info@sbilife.co.in

22 Shriram Life Insurance Company Limited. 1800-3000-6116 customercare@shriramlife.in

grievance.redressal@shriramlife.in

23 Star Union Dai-ichi Life Insurance 1800 266 8833 customercare@sudlife.in

Company Limited. 022 39546300

24 Tata AIA Life Insurance Company Limited. 1860-266-9966 life.complaints@tataaia.com

IRDAI gives approval to Paytm Insurance Broking

The IRDAI has given the approval to Paytm to embark into the insurance business. Paytm will foray into the insurance

business with subsidiary Paytm Insurance Broking.

The insurance company is planning to offer insurance products all over the four categories inclusive of auto, health,

and life. In addition to that, customers will also be able to avail policy management and claim settlement services at

select merchant points, stated the company.

“This would enable us to offer a wider suite of product offerings from a large set of insurance partners. The potential

of the insurance business is huge as the market is still under-penetrated in India. As a company, we fully rely and trust

on our merchant partners, selling insurance products and augmenting their income options while driving penetration,"

said Amit Nayyar, President, Paytm.

LIC launches two new ULIPs, opens two new offices in Puducherry

LIC has launched two new unit-linked plans, Nivesh Plus and SIIP, while opening two new offices in Puducherry.

Chief Minister V. Narayanasamy has marked the opening of a city sales office for LIC credit cards and a BIMA Connect

office on Chetty Street.

K. Kadiresan, LIC zonal manager explained the features of the two policies. According to him, the Nivesh Plus Plan is

a single premium, non-participating, unit-linked, individual life insurance plan offering insurance cum investment during

the term of the policy. It starts with a minimum 1lakh in single premium mode. The sum assured options are 1.25

times the Single Premium or 10 times the Single Premium.

The LIC SIIP is more a regular insurance/investment plan, with minimum premium of Rs. 40,000 (for yearly mode)

with no maximum premium limit. The proposer can choose the amount of premium. Upon the completion of specified

policy years, guaranteed additions as a percentage of annualised premium shall be added to the Unit Fund under an

in-force policy. The basic sum assured, offered for ages below 55 years, is 10 times annualised premium and, for ages

55 years and above it is 7 times annualised premium.

I will go anywhere as long as it's forward.

Life Insurance Today January - June 2020 31