Page 23 - The Insurance Times January 2025

P. 23

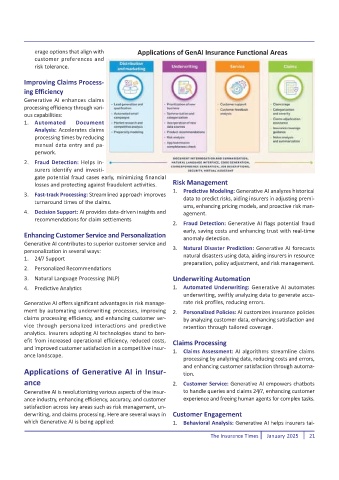

erage options that align with Applications of GenAI Insurance Functional Areas

customer preferences and

risk tolerance.

Improving Claims Process-

ing Efficiency

Generative AI enhances claims

processing efficiency through vari-

ous capabilities:

1. Automated Document

Analysis: Accelerates claims

processing times by reducing

manual data entry and pa-

perwork.

2. Fraud Detection: Helps in-

surers identify and investi-

gate potential fraud cases early, minimizing financial

losses and protecting against fraudulent activities. Risk Management

1. Predictive Modeling: Generative AI analyzes historical

3. Fast-track Processing: Streamlined approach improves

data to predict risks, aiding insurers in adjusting premi-

turnaround times of the claims.

ums, enhancing pricing models, and proactive risk man-

4. Decision Support: AI provides data-driven insights and agement.

recommendations for claim settlements

2. Fraud Detection: Generative AI flags potential fraud

early, saving costs and enhancing trust with real-time

Enhancing Customer Service and Personalization

anomaly detection.

Generative AI contributes to superior customer service and

3. Natural Disaster Prediction: Generative AI forecasts

personalization in several ways:

1. 24/7 Support natural disasters using data, aiding insurers in resource

preparation, policy adjustment, and risk management.

2. Personalized Recommendations

3. Natural Language Processing (NLP) Underwriting Automation

4. Predictive Analytics 1. Automated Underwriting: Generative AI automates

underwriting, swiftly analyzing data to generate accu-

Generative AI offers significant advantages in risk manage- rate risk profiles, reducing errors.

ment by automating underwriting processes, improving 2. Personalized Policies: AI customizes insurance policies

claims processing efficiency, and enhancing customer ser- by analyzing customer data, enhancing satisfaction and

vice through personalized interactions and predictive retention through tailored coverage.

analytics. Insurers adopting AI technologies stand to ben-

efit from increased operational efficiency, reduced costs, Claims Processing

and improved customer satisfaction in a competitive insur- 1. Claims Assessment: AI algorithms streamline claims

ance landscape.

processing by analyzing data, reducing costs and errors,

and enhancing customer satisfaction through automa-

Applications of Generative AI in Insur- tion.

ance 2. Customer Service: Generative AI empowers chatbots

Generative AI is revolutionizing various aspects of the insur- to handle queries and claims 24/7, enhancing customer

ance industry, enhancing efficiency, accuracy, and customer experience and freeing human agents for complex tasks.

satisfaction across key areas such as risk management, un-

derwriting, and claims processing. Here are several ways in Customer Engagement

which Generative AI is being applied: 1. Behavioral Analysis: Generative AI helps insurers tai-

The Insurance Times January 2025 21