Page 28 - The Insurance Times January 2025

P. 28

Future Outlook growth in the banking sector. Generative AI uses models like

GANs and VAEs to analyze data and refine insurance prac-

The integration of Generative AI technologies is set to revo-

lutionize the insurance industry, enhancing risk assessment, tices.

underwriting automation, and customer engagement

through trends like explainable AI, federated learning, and Reference:

AI-driven dynamic pricing models. By collaborating with https://marketresearch.biz/report/generative-ai-in-insur-

technology partners, insurers can leverage Generative AI to ance-market/

boost operational efficiency, improve risk management, and

deliver superior customer experiences. Conclusion

Generative AI has been rampant in multiple industries and

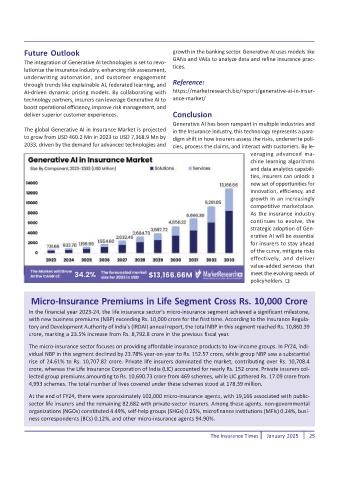

The global Generative AI in Insurance Market is projected in the Insurance Industry, this technology represents a para-

to grow from USD 460.2 Mn in 2023 to USD 7,368.9 Mn by digm shift in how insurers assess the risks, underwrite poli-

2033, driven by the demand for advanced technologies and cies, process the claims, and interact with customers. By le-

veraging advanced ma-

chine learning algorithms

and data analytics capabili-

ties, insurers can unlock a

new set of opportunities for

innovation, efficiency, and

growth in an increasingly

competitive marketplace.

As the insurance industry

continues to evolve, the

strategic adoption of Gen-

erative AI will be essential

for insurers to stay ahead

of the curve, mitigate risks

effectively, and deliver

value-added services that

meet the evolving needs of

policyholders.

Micro-Insurance Premiums in Life Segment Cross Rs. 10,000 Crore

In the financial year 2023-24, the life insurance sector's micro-insurance segment achieved a significant milestone,

with new business premiums (NBP) exceeding Rs. 10,000 crore for the first time. According to the Insurance Regula-

tory and Development Authority of India's (IRDAI) annual report, the total NBP in this segment reached Rs. 10,860.39

crore, marking a 23.5% increase from Rs. 8,792.8 crore in the previous fiscal year.

The micro-insurance sector focuses on providing affordable insurance products to low-income groups. In FY24, indi-

vidual NBP in this segment declined by 23.78% year-on-year to Rs. 152.57 crore, while group NBP saw a substantial

rise of 24.61% to Rs. 10,707.82 crore. Private life insurers dominated the market, contributing over Rs. 10,708.4

crore, whereas the Life Insurance Corporation of India (LIC) accounted for nearly Rs. 152 crore. Private insurers col-

lected group premiums amounting to Rs. 10,690.73 crore from 469 schemes, while LIC gathered Rs. 17.09 crore from

4,993 schemes. The total number of lives covered under these schemes stood at 178.39 million.

At the end of FY24, there were approximately 102,000 micro-insurance agents, with 19,166 associated with public-

sector life insurers and the remaining 82,682 with private-sector insurers. Among these agents, non-governmental

organizations (NGOs) constituted 4.49%, self-help groups (SHGs) 0.25%, microfinance institutions (MFIs) 0.24%, busi-

ness correspondents (BCs) 0.12%, and other micro-insurance agents 94.90%.

The Insurance Times January 2025 25