Page 31 - The Insurance Times January 2025

P. 31

452% in 2022-23 as compare to 2021-22. But the commis- and business strategies for the benefit of its future course

sion expenses ratio slightly increased to 5.41% in 2022-23 of business and for the benefit of policy holders.

from 5.18% in 2021-22.

7.2 As the newly coming private life insurance companies

6. Insurance Penetration and Insurance are mainly trying to enter the untouched rural areas so LICI

has to arrange insurance awareness programme in the ru-

Density ral areas to expand their business.

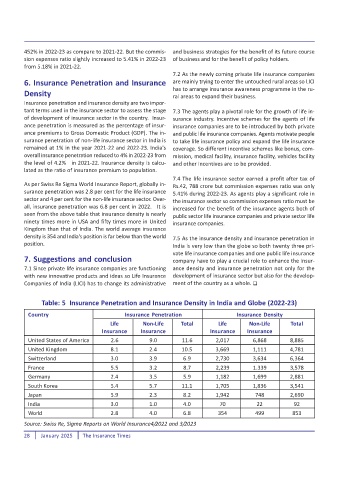

Insurance penetration and insurance density are two impor-

tant terms used in the insurance sector to assess the stage 7.3 The agents play a pivotal role for the growth of life in-

of development of insurance sector in the country. Insur- surance industry. Incentive schemes for the agents of life

ance penetration is measured as the percentage of insur- insurance companies are to be introduced by both private

ance premiums to Gross Domestic Product (GDP). The in- and public life insurance companies. Agents motivate people

surance penetration of non-life insurance sector in India is to take life insurance policy and expand the life insurance

remained at 1% in the year 2021-22 and 2022-23. India's coverage. So different incentive schemes like bonus, com-

overall insurance penetration reduced to 4% in 2022-23 from mission, medical facility, insurance facility, vehicles facility

the level of 4.2% in 2021-22. Insurance density is calcu- and other incentives are to be provided.

lated as the ratio of insurance premium to population.

7.4 The life insurance sector earned a profit after tax of

As per Swiss Re Sigma World Insurance Report, globally in- Rs.42, 788 crore but commission expenses ratio was only

surance penetration was 2.8 per cent for the life insurance 5.41% during 2022-23. As agents play a significant role in

sector and 4 per cent for the non-life insurance sector. Over- the insurance sector so commission expenses ratio must be

all, insurance penetration was 6.8 per cent in 2022. It is increased for the benefit of the insurance agents both of

seen from the above table that insurance density is nearly public sector life insurance companies and private sector life

ninety times more in USA and fifty times more in United insurance companies.

Kingdom than that of India. The world average insurance

density is 354 and India's position is far below than the world 7.5 As the insurance density and insurance penetration in

position. India is very low than the globe so both twenty three pri-

vate life insurance companies and one public life insurance

7. Suggestions and conclusion company have to play a crucial role to enhance the insur-

7.1 Since private life insurance companies are functioning ance density and insurance penetration not only for the

with new innovative products and ideas so Life Insurance development of insurance sector but also for the develop-

Companies of India (LICI) has to change its administrative ment of the country as a whole.

Table: 5 Insurance Penetration and Insurance Density in India and Globe (2022-23)

Country Insurance Penetration Insurance Density

Life Non-Life Total Life Non-Life Total

Insurance Insurance Insurance Insurance

United States of America 2.6 9.0 11.6 2,017 6,868 8,885

United Kingdom 8.1 2.4 10.5 3,669 1,111 4,781

Switzerland 3.0 3.9 6.9 2,730 3,634 6,364

France 5.5 3.2 8.7 2,239 1.339 3,578

Germany 2.4 3.5 5.9 1,182 1,699 2,881

South Korea 5.4 5.7 11.1 1,705 1,836 3,541

Japan 5.9 2.3 8.2 1,942 748 2,690

India 3.0 1.0 4.0 70 22 92

World 2.8 4.0 6.8 354 499 853

Source: Swiss Re, Sigma Reports on World Insurance4/2022 and 3/2023

28 January 2025 The Insurance Times