Page 29 - The Insurance Times January 2025

P. 29

Life Insurance

Issues Concerning

Enhancement of

Life Insurance

Dr. Jaydeb Bera

Density in India Associate Professor and Head

Department of Commerce

Pingla, Paschim Medinipur

The private sector life insurers have clocked a growth of 16.34% in premium, while the public sector

life insurer recorded 10.90% growth in premium. The main object of the present study is to show

there are several infrastructural and administrative problems for the development of insurance

sector. It results low insurance density and low insurance penetration in India.

1. Introduction opment of insurance sector. It results low insurance density

and low insurance penetration in India.

Insurance industry plays a pivotal role for the socio-economic

development of a country. The life insurance market in In-

dia has recorded a consistent premium growth over the 2. Position of life insurance companies

years. During 2022-2023, the Life insurance industry re- At present twenty four life insurance companies are oper-

corded a premium of Rs.7.83 lakh crore registering 12.98% ating in India, of which twenty three life insurance compa-

growths. The private sector life insurers have clocked a nies are private and one is public sector.

growth of 16.34% in premium, while the public sector life

insurer recorded 10.90% growth in premium. The main During 2022-23, the life insurance industry registered a

object of the present study is to show there are several growth of 12.98% in the premium underwritten against the

infrastructural and administrative problems for the devel- previous financial year 2021-22. But the rate of growth is

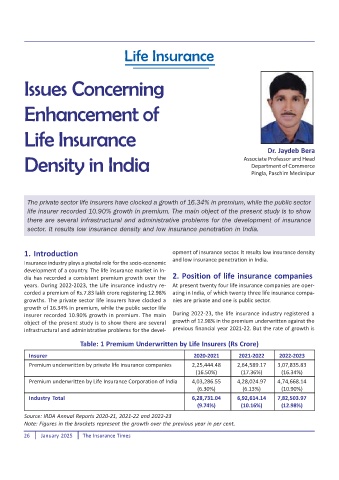

Table: 1 Premium Underwritten by Life Insurers (Rs Crore)

Insurer 2020-2021 2021-2022 2022-2023

Premium underwritten by private life insurance companies 2,25,444.48 2,64,589.17 3,07,835.83

(16.50%) (17.36%) (16.34%)

Premium underwritten by Life Insurance Corporation of India 4,03,286.55 4,28,024.97 4,74,668.14

(6.30%) (6.13%) (10.90%)

Industry Total 6,28,731.04 6,92,614.14 7,82,503.97

(9.74%) (10.16%) (12.98%)

Source: IRDA Annual Reports 2020-21, 2021-22 and 2022-23

Note: Figures in the brackets represent the growth over the previous year in per cent.

26 January 2025 The Insurance Times