Page 42 - WOW Magazine Dec22_V04

P. 42

RRB:

The RRBs are geographically in the same regions and mirror our existing banca network, it is evident that they need

dedicated attention to be brought at-par with the overall banca channel. Given the density of the RRB network in their

respective regions, a dedicated approach will help us maximize the return from this pool. They also contribute 13.65

Lacs active PMJJBY customers to our portfolio – Aryavart Bank and MP Gramin Bank, with focus exclusively on Metro,

Urban & Semi-urban branches. We have further expanded our footprint on this space and have onboarded Vidharbha

Konkan Gramin Bank and Chaitanya Godavari Gramin bank during this financial year.

New Partnerships – Corporate Agency, Broking & Strategic Alliances

We are still nascent in our journey in expanding our footprints in the Corporate Agency and Broking space. We

currently have 5 working Brokers & 3 Corporate Agent partners acquired during this financial year. These new

partnerships will start contributing to our business effectively from Q4 onwards.

We are continuously on the lookout for adding new productive partnerships and have made forays in the same. With

IRDA taking appropriate insurance solutions to fulfil its mission of ‘Insurance for All’ by 2047, have increased the tie-up

limits of intermediaries. Now a Corporate Agent can tie up with 9 insurers (earlier 3 insurers) and Insurance Marketing

Firms can tie up with 6 insurers (earlier 2 insurers). This further opens our door to expand our partnerships across

current 570+ registered corporate agents on LI space further to their existing LI partners.

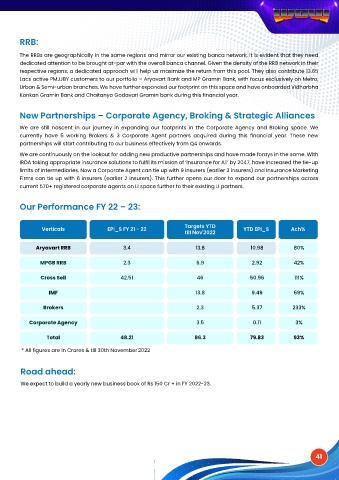

Our Performance FY 22 – 23:

Targets YTD

Verticals EPI_S FY 21 - 22 YTD EPI_S Ach%

till Nov'2022

Aryavart RRB 3.4 13.8 10.98 80%

MPGB RRB 2.3 6.9 2.92 42%

Cross Sell 42.51 46 50.96 111%

IMF 13.8 9.49 69%

Brokers 2.3 5.37 233%

Corporate Agency 3.5 0.11 3%

Total 48.21 86.3 79.83 93%

* All figures are in Crores & till 30th November'2022

Road ahead:

We expect to build a yearly new business book of Rs 150 Cr + in FY 2022-23.

41