Page 36 - Insurance Times March 2021

P. 36

support the insurance business in India, with proper to increase the FDI limit in insurance companies to 74% from

regulations, which will help to achieve the national agenda the present 49%, with Indian management control. Under

of 'financial inclusion' in the country. the new structure, majority of directors and management

persons would be resident Indians with at least 50% of the

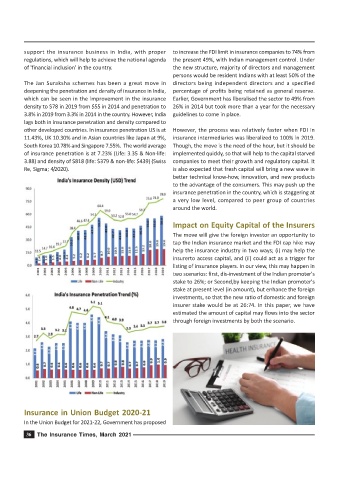

The Jan Suraksha schemes has been a great move in directors being independent directors and a specified

deepening the penetration and density of insurance in India, percentage of profits being retained as general reserve.

which can be seen in the improvement in the insurance Earlier, Government has liberalised the sector to 49% from

density to $78 in 2019 from $55 in 2014 and penetration to 26% in 2014 but took more than a year for the necessary

3.8% in 2019 from 3.3% in 2014 in the country. However, India guidelines to come in place.

lags both in insurance penetration and density compared to

other developed countries. In insurance penetration US is at However, the process was relatively faster when FDI in

11.43%, UK 10.30% and in Asian countries like Japan at 9%, insurance intermediaries was liberalized to 100% in 2019.

South Korea 10.78% and Singapore 7.55%. The world average Though, the move is the need of the hour, but it should be

of insurance penetration is at 7.23% (Life: 3.35 & Non-life: implemented quickly, so that will help to the capital starved

3.88) and density of $818 (life: $379 & non-life: $439) (Swiss companies to meet their growth and regulatory capital. It

Re, Sigma; 4/2020). is also expected that fresh capital will bring a new wave in

better technical know-how, innovation, and new products

to the advantage of the consumers. This may push up the

insurance penetration in the country, which is staggering at

a very low level, compared to peer group of countries

around the world.

Impact on Equity Capital of the Insurers

The move will give the foreign investor an opportunity to

tap the Indian insurance market and the FDI cap hike may

help the insurance industry in two ways; (i) may help the

insurerto access capital, and (ii) could act as a trigger for

listing of insurance players. In our view, this may happen in

two scenarios: first, dis-investment of the Indian promoter's

stake to 26%; or Second,by keeping the Indian promoter's

stake at present level (in amount), but enhance the foreign

investments, so that the new ratio of domestic and foreign

insurer stake would be at 26:74. In this paper, we have

estimated the amount of capital may flows into the sector

through foreign investments by both the scenario.

Insurance in Union Budget 2020-21

In the Union Budget for 2021-22, Government has proposed

36 The Insurance Times, March 2021