Page 25 - Insurance Times November 2022

P. 25

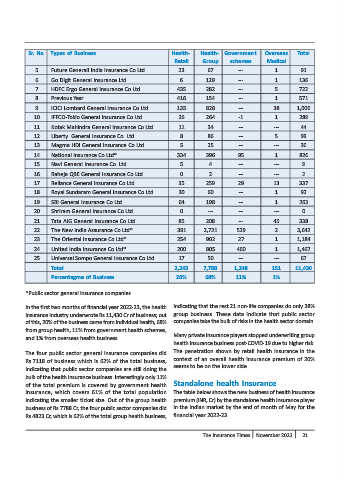

Sr. No Types of Business Health- Health- Government Overseas Total

Retail Group schemes Medical

5 Future Generali India Insurance Co Ltd 23 67 --- 1 91

6 Go Digit General Insurance Ltd 6 129 --- 1 136

7 HDFC Ergo General Insurance Co Ltd 435 282 --- 5 722

8 Previous Year 416 154 --- 1 571

9 ICICI Lombard General Insurance Co Ltd 135 828 --- 38 1,000

10 IFFCO-Tokio General Insurance Co Ltd 26 264 -1 1 289

11 Kotak Mahindra General Insurance Co Ltd 11 34 --- --- 44

12 Liberty General Insurance Co. Ltd 8 86 --- 5 99

13 Magma HDI General Insurance Co Ltd 5 25 --- --- 30

14 National Insurance Co Ltd* 334 396 95 1 826

15 Navi General Insurance Co. Ltd 5 4 --- --- 9

16 Raheja QBE General Insurance Co Ltd 0 2 --- --- 2

17 Reliance General Insurance Co Ltd 35 259 29 13 337

18 Royal Sundaram General Insurance Co Ltd 30 60 --- 1 92

19 SBI General Insurance Co Ltd 64 198 --- 1 263

20 Shriram General Insurance Co Ltd 0 --- --- --- 0

21 Tata AIG General Insurance Co Ltd 85 208 --- 45 338

22 The New India Assurance Co Ltd* 391 2,721 529 2 3,642

23 The Oriental Insurance Co Ltd* 254 902 27 1 1,184

24 United India Insurance Co Ltd* 200 805 460 1 1,467

25 Universal Sompo General Insurance Co Ltd 17 50 --- --- 67

Total 2,243 7,788 1,248 151 11,430

Percentagme of Business 20% 68% 11% 1%

*Public sector general insurance companies

In the first two months of financial year 2022-23, the health indicating that the rest 21 non-life companies do only 38%

insurance industry underwrote Rs.11,430 Cr of business; out group business. These data indicate that public sector

of this, 20% of the business came from individual health, 68% companies take the bulk of risks in the health sector domain.

from group health, 11% from government health schemes,

Many private insurance players stopped underwriting group

and 1% from overseas health business.

health insurance business post-COVID-19 due to higher risk.

The penetration shown by retail health insurance in the

The four public sector general insurance companies did

context of an overall health insurance premium of 20%

Rs.7118 of business which is 62% of the total business,

seems to be on the lower side.

indicating that public sector companies are still doing the

bulk of the health insurance business. Interestingly only 11%

of the total premium is covered by government health Standalone health Insurance

insurance, which covers 61% of the total population The table below shows the new business of health insurance

indicating the smaller ticket size. Out of the group health premium (INR, Cr) by the standalone health insurance player

business of Rs.7788 Cr, the four public sector companies did in the Indian market by the end of month of May for the

Rs.4823 Cr, which is 62% of the total group health business, financial year 2022-23.

The Insurance Times November 2022 21