Page 26 - Insurance Times November 2022

P. 26

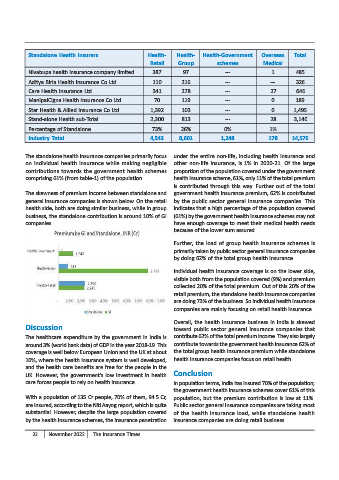

Standalone Health Insurers Health- Health- Health-Government Overseas Total

Retail Group schemes Medical

Nivabupa health insurance company limited 387 97 --- 1 485

Aditya Birla Health Insurance Co Ltd 110 216 --- --- 326

Care Health Insurance Ltd 341 278 --- 27 646

ManipalCigna Health Insurance Co Ltd 70 119 --- 0 189

Star Health & Allied Insurance Co Ltd 1,392 103 --- 0 1,495

Stand-alone Health sub-Total 2,300 813 --- 28 3,140

Percentage of Standalone 73% 26% 0% 1%

Industry Total 4,543 8,601 1,248 178 14,570

The standalone health insurance companies primarily focus under the entire non-life, including health insurance and

on individual health insurance while making negligible other non-life insurance, is 1% in 2020-21. Of the large

contributions towards the government health schemes proportion of the population covered under the government

comprising 61% (from table-1) of the population. health insurance scheme, 61%, only 11% of the total premium

is contributed through this way. Further out of the total

The skewness of premium income between standalone and government health insurance premium, 62% is contributed

general insurance companies is shown below. On the retail by the public sector general insurance companies. This

health side, both are doing similar business, while in group indicates that a high percentage of the population covered

business, the standalone contribution is around 10% of GI (61%) by the government health insurance schemes may not

companies. have enough coverage to meet their medical health needs

because of the lower sum assured.

Further, the load of group health insurance schemes is

primarily taken by public sector general insurance companies

by doing 62% of the total group health insurance.

Individual health insurance coverage is on the lower side,

visible both from the population covered (9%) and premium

collected 20% of the total premium. Out of this 20% of the

retail premium, the standalone health insurance companies

are doing 73% of the business. So individual health insurance

companies are mainly focusing on retail health insurance.

Overall, the health insurance business in India is skewed

Discussion toward public sector general insurance companies that

The healthcare expenditure by the government in India is contribute 62% of the total premium income. They also largely

around 3% (world bank data) of GDP in the year 2018-19. This contribute towards the government health insurance 62% of

coverage is well below European Union and the UK at about the total group health insurance premium while standalone

10%, where the health insurance system is well developed, health insurance companies focus on retail health.

and the health care benefits are free for the people in the

UK. However, the government's low investment in health Conclusion

care forces people to rely on health insurance. In population terms, India has insured 70% of the population;

the government health insurance schemes cover 61% of this

With a population of 135 Cr people, 70% of them, 94.5 Cr, population, but the premium contribution is low at 11%.

are insured, according to the Niti Aayog report, which is quite Public sector general insurance companies are taking most

substantial. However, despite the large population covered of the health insurance load, while standalone health

by the health insurance schemes, the insurance penetration insurance companies are doing retail business.

22 November 2022 The Insurance Times