Page 111 - IC26 LIFE INSURANCE FINANCE

P. 111

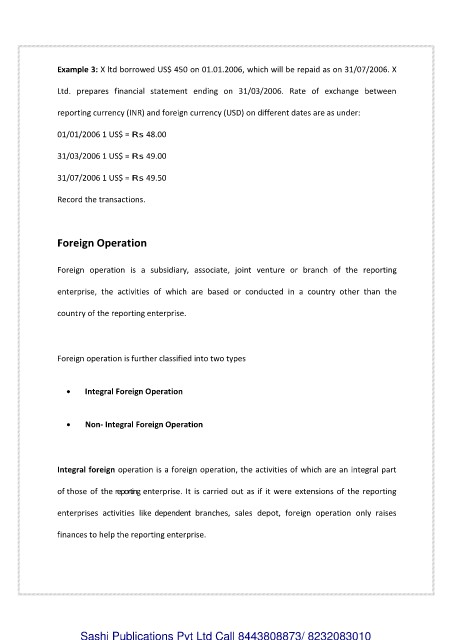

Example 3: X ltd borrowed US$ 450 on 01.01.2006, which will be repaid as on 31/07/2006. X

Ltd. prepares financial statement ending on 31/03/2006. Rate of exchange between

reporting currency (INR) and foreign currency (USD) on different dates are as under:

01/01/2006 1 US$ = Rs 48.00

31/03/2006 1 US$ = Rs 49.00

31/07/2006 1 US$ = Rs 49.50

Record the transactions.

Foreign Operation

Foreign operation is a subsidiary, associate, joint venture or branch of the reporting

enterprise, the activities of which are based or conducted in a country other than the

country of the reporting enterprise.

Foreign operation is further classified into two types

Integral Foreign Operation

Non- Integral Foreign Operation

Integral foreign operation is a foreign operation, the activities of which are an integral part

of those of the reporting enterprise. It is carried out as if it were extensions of the reporting

enterprises activities like dependent branches, sales depot, foreign operation only raises

finances to help the reporting enterprise.

Sashi Publications Pvt Ltd Call 8443808873/ 8232083010