Page 116 - IC26 LIFE INSURANCE FINANCE

P. 116

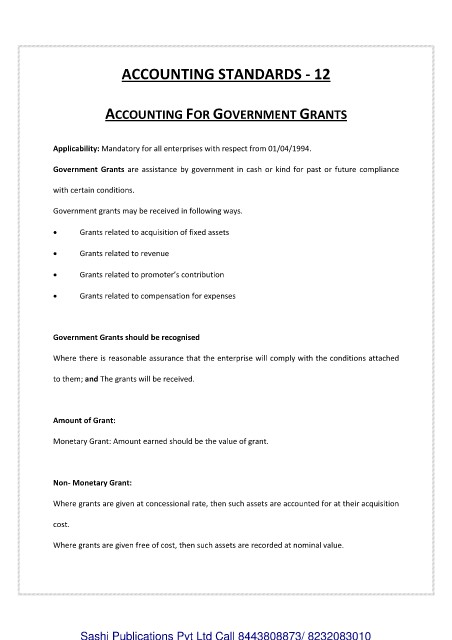

ACCOUNTING STANDARDS - 12

ACCOUNTING FOR GOVERNMENT GRANTS

Applicability: Mandatory for all enterprises with respect from 01/04/1994.

Government Grants are assistance by government in cash or kind for past or future compliance

with certain conditions.

Government grants may be received in following ways.

Grants related to acquisition of fixed assets

Grants related to revenue

Grants related to promoter’s contribution

Grants related to compensation for expenses

Government Grants should be recognised

Where there is reasonable assurance that the enterprise will comply with the conditions attached

to them; and The grants will be received.

Amount of Grant:

Monetary Grant: Amount earned should be the value of grant.

Non- Monetary Grant:

Where grants are given at concessional rate, then such assets are accounted for at their acquisition

cost.

Where grants are given free of cost, then such assets are recorded at nominal value.

Sashi Publications Pvt Ltd Call 8443808873/ 8232083010