Page 112 - IC26 LIFE INSURANCE FINANCE

P. 112

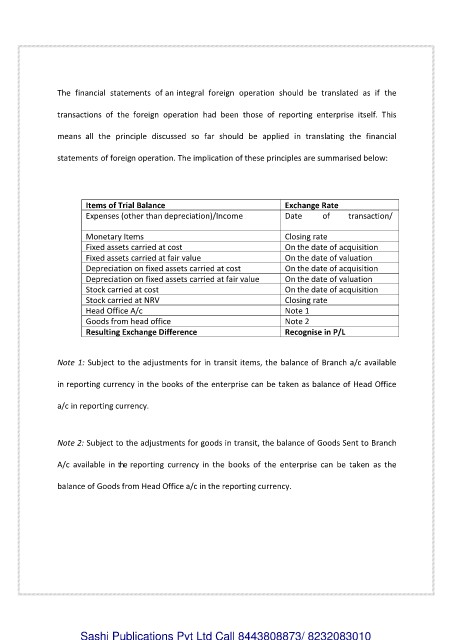

The financial statements of an integral foreign operation should be translated as if the

transactions of the foreign operation had been those of reporting enterprise itself. This

means all the principle discussed so far should be applied in translating the financial

statements of foreign operation. The implication of these principles are summarised below:

Items of Trial Balance Exchange Rate

Expenses (other than depreciation)/Income Date of transaction/

Monetary Items Closing rate

Fixed assets carried at cost On the date of acquisition

Fixed assets carried at fair value On the date of valuation

Depreciation on fixed assets carried at cost On the date of acquisition

Depreciation on fixed assets carried at fair value On the date of valuation

Stock carried at cost On the date of acquisition

Stock carried at NRV Closing rate

Head Office A/c Note 1

Goods from head office Note 2

Resulting Exchange Difference Recognise in P/L

Note 1: Subject to the adjustments for in transit items, the balance of Branch a/c available

in reporting currency in the books of the enterprise can be taken as balance of Head Office

a/c in reporting currency.

Note 2: Subject to the adjustments for goods in transit, the balance of Goods Sent to Branch

A/c available in the reporting currency in the books of the enterprise can be taken as the

balance of Goods from Head Office a/c in the reporting currency.

Sashi Publications Pvt Ltd Call 8443808873/ 8232083010