Page 12 - IC26 LIFE INSURANCE FINANCE

P. 12

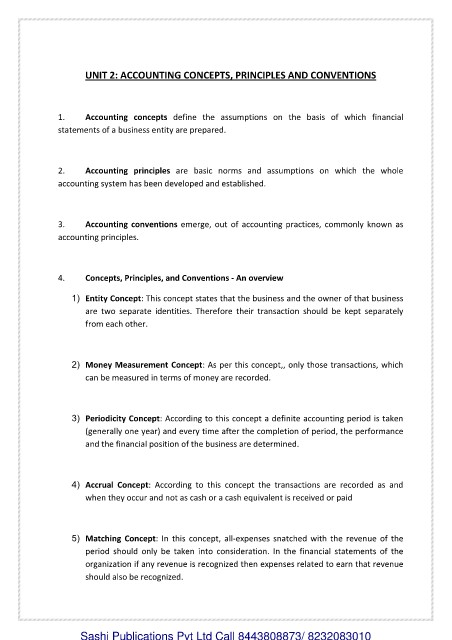

UNIT 2: ACCOUNTING CONCEPTS, PRINCIPLES AND CONVENTIONS

1. Accounting concepts define the assumptions on the basis of which financial

statements of a business entity are prepared.

2. Accounting principles are basic norms and assumptions on which the whole

accounting system has been developed and established.

3. Accounting conventions emerge, out of accounting practices, commonly known as

accounting principles.

4. Concepts, Principles, and Conventions - An overview

1) Entity Concept: This concept states that the business and the owner of that business

are two separate identities. Therefore their transaction should be kept separately

from each other.

2) Money Measurement Concept: As per this concept,, only those transactions, which

can be measured in terms of money are recorded.

3) Periodicity Concept: According to this concept a definite accounting period is taken

(generally one year) and every time after the completion of period, the performance

and the financial position of the business are determined.

4) Accrual Concept: According to this concept the transactions are recorded as and

when they occur and not as cash or a cash equivalent is received or paid

5) Matching Concept: In this concept, all-expenses snatched with the revenue of the

period should only be taken into consideration. In the financial statements of the

organization if any revenue is recognized then expenses related to earn that revenue

should also be recognized.

Sashi Publications Pvt Ltd Call 8443808873/ 8232083010