Page 16 - IC26 LIFE INSURANCE FINANCE

P. 16

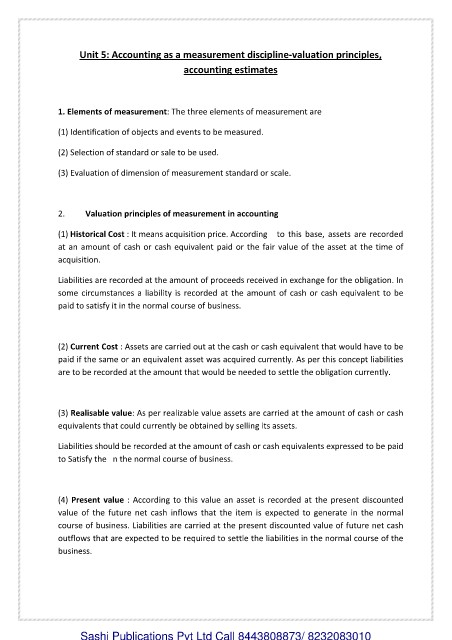

Unit 5: Accounting as a measurement discipline-valuation principles,

accounting estimates

1. Elements of measurement: The three elements of measurement are

(1) Identification of objects and events to be measured.

(2) Selection of standard or sale to be used.

(3) Evaluation of dimension of measurement standard or scale.

2. Valuation principles of measurement in accounting

(1) Historical Cost : It means acquisition price. According to this base, assets are recorded

at an amount of cash or cash equivalent paid or the fair value of the asset at the time of

acquisition.

Liabilities are recorded at the amount of proceeds received in exchange for the obligation. In

some circumstances a liability is recorded at the amount of cash or cash equivalent to be

paid to satisfy it in the normal course of business.

(2) Current Cost : Assets are carried out at the cash or cash equivalent that would have to be

paid if the same or an equivalent asset was acquired currently. As per this concept liabilities

are to be recorded at the amount that would be needed to settle the obligation currently.

(3) Realisable value: As per realizable value assets are carried at the amount of cash or cash

equivalents that could currently be obtained by selling its assets.

Liabilities should be recorded at the amount of cash or cash equivalents expressed to be paid

to Satisfy the n the normal course of business.

(4) Present value : According to this value an asset is recorded at the present discounted

value of the future net cash inflows that the item is expected to generate in the normal

course of business. Liabilities are carried at the present discounted value of future net cash

outflows that are expected to be required to settle the liabilities in the normal course of the

business.

Sashi Publications Pvt Ltd Call 8443808873/ 8232083010