Page 44 - IC26 LIFE INSURANCE FINANCE

P. 44

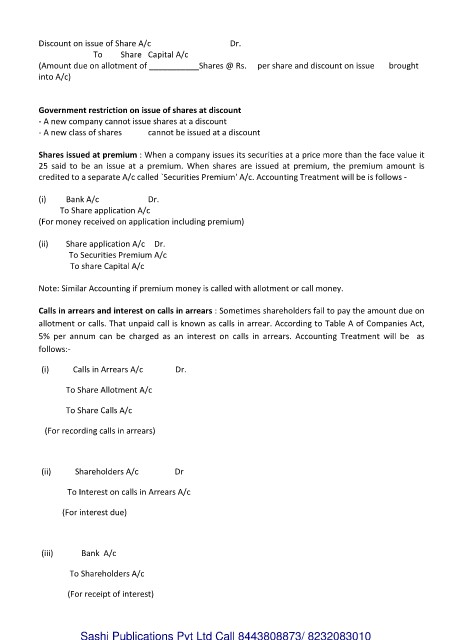

Discount on issue of Share A/c Dr.

To Share Capital A/c

(Amount due on allotment of ___________Shares @ Rs. per share and discount on issue brought

into A/c)

Government restriction on issue of shares at discount

- A new company cannot issue shares at a discount

- A new class of shares cannot be issued at a discount

Shares issued at premium : When a company issues its securities at a price more than the face value it

25 said to be an issue at a premium. When shares are issued at premium, the premium amount is

credited to a separate A/c called `Securities Premium' A/c. Accounting Treatment will be is follows -

(i) Bank A/c Dr.

To Share application A/c

(For money received on application including premium)

(ii) Share application A/c Dr.

To Securities Premium A/c

To share Capital A/c

Note: Similar Accounting if premium money is called with allotment or call money.

Calls in arrears and interest on calls in arrears : Sometimes shareholders fail to pay the amount due on

allotment or calls. That unpaid call is known as calls in arrear. According to Table A of Companies Act,

5% per annum can be charged as an interest on calls in arrears. Accounting Treatment will be as

follows:-

(i) Calls in Arrears A/c Dr.

To Share Allotment A/c

To Share Calls A/c

(For recording calls in arrears)

(ii) Shareholders A/c Dr

To Interest on calls in Arrears A/c

(For interest due)

(iii) Bank A/c

To Shareholders A/c

(For receipt of interest)

Sashi Publications Pvt Ltd Call 8443808873/ 8232083010