Page 45 - IC26 LIFE INSURANCE FINANCE

P. 45

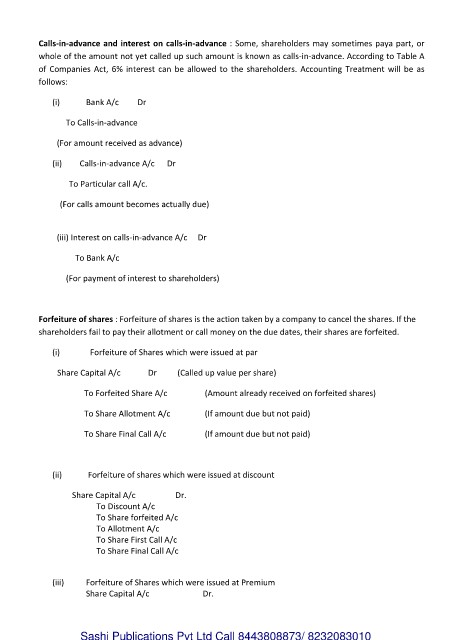

Calls-in-advance and interest on calls-in-advance : Some, shareholders may sometimes paya part, or

whole of the amount not yet called up such amount is known as calls-in-advance. According to Table A

of Companies Act, 6% interest can be allowed to the shareholders. Accounting Treatment will be as

follows:

(i) Bank A/c Dr

To Calls-in-advance

(For amount received as advance)

(ii) Calls-in-advance A/c Dr

To Particular call A/c.

(For calls amount becomes actually due)

(iii) Interest on calls-in-advance A/c Dr

To Bank A/c

(For payment of interest to shareholders)

Forfeiture of shares : Forfeiture of shares is the action taken by a company to cancel the shares. If the

shareholders fail to pay their allotment or call money on the due dates, their shares are forfeited.

(i) Forfeiture of Shares which were issued at par

Share Capital A/c Dr (Called up value per share)

To Forfeited Share A/c (Amount already received on forfeited shares)

To Share Allotment A/c (If amount due but not paid)

To Share Final Call A/c (If amount due but not paid)

(ii) Forfeiture of shares which were issued at discount

Share Capital A/c Dr.

To Discount A/c

To Share forfeited A/c

To Allotment A/c

To Share First Call A/c

To Share Final Call A/c

(iii) Forfeiture of Shares which were issued at Premium

Share Capital A/c Dr.

Sashi Publications Pvt Ltd Call 8443808873/ 8232083010