Page 44 - Insurance Times March 2023

P. 44

IRDAI

Appraisal of Life Insurance Market

Life Insurance Premium at 63.18 per cent in new business and 60.65 per cent in

renewal business premium.

Life insurance industry recorded a premium income of Rs.

6.93 lakh crore during 2021-22 as against Rs. 6.29 lakh crore

Insurance company-wise life insurance premium is provided

in the previous financial year, registering growth of 10.16

in Statement 3.

per cent. While private sector insurers posted 17.36 per

cent growth in premium, LIC recorded 6.13 per cent growth.

LIC of India is the only Indian insurer underwriting life

The market share of LIC decreased by 2.34 per cent to 61.80

insurance business outside India. The total premium

per cent in 2021-22 while market share of private insurers

underwritten outside the country by LIC stood at ?419.70

has increased to 38.20 per cent.

crore in 2021-22 as against ?400.34 crore in 2020-21

registering a growth of 4.83 per cent against growth of 5.84

In 2021-22, new business and renewal premium accounted

per cent in 2020-21.

for 45.46 per cent and 54.54 per cent of the total premium

received by life insurers respectively. New business premium

recorded 12.98 per cent growth while renewal business had Segment-wise Life Insurance Premium

a growth of 7.92 per cent. Single premium products continue The traditional products registered a growth of 10.15 per

to play a major role for LIC as they contributed 37.91 per cent in 2021-22, with premium of Rs. 5.92 lakh crore as

cent of total premium while it was 15.87 per cent for private against Rs. 5.38 lakh crore in previous year. On the other

life insurers. LIC continued to have a higher market share hand, Unit-linked products (ULIPs) registered a growth of

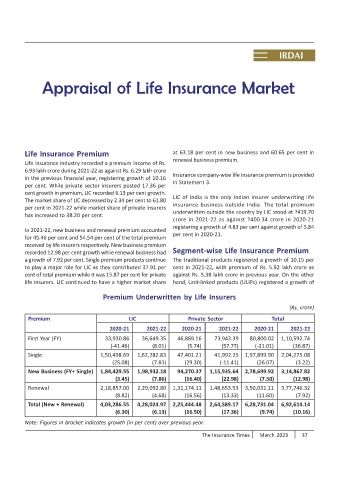

Premium Underwritten by Life Insurers

(Rs. crore)

Premium LIC Private Sector Total

2020-21 2021-22 2020-21 2021-22 2020-21 2021-22

First Year (FY) 33,930.86 36,649.35 46,869.16 73,943.39 80,800.02 1,10,592.74

(-41.46) (8.01) (5.74) (57.77) (-21.01) (36.87)

Single 1,50,498.69 1,62,282.83 47,401.21 41,992.25 1,97,899.90 2,04,275.08

(25.08) (7.83) (29.30) (-11.41) (26.07) (3.22)

New Business (FY+ Single) 1,84,429.55 1,98,932.18 94,270.37 1,15,935.64 2,78,699.92 3,14,867.82

(3.45) (7.86) (16.40) (22.98) (7.50) (12.98)

Renewal 2,18,857.00 2,29,092.80 1,31,174.11 1,48,653.53 3,50,031.11 3,77,746.32

(8.82) (4.68) (16.56) (13.33) (11.60) (7.92)

Total (New + Renewal) 4,03,286.55 4,28,024.97 2,25,444.48 2,64,589.17 6,28,731.04 6,92,614.14

(6.30) (6.13) (16.50) (17.36) (9.74) (10.16)

Note: Figures in bracket indicates growth (in per cent) over previous year.

The Insurance Times March 2023 37