Page 48 - Insurance Times March 2023

P. 48

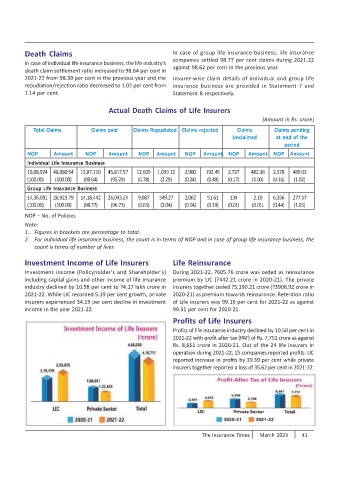

Death Claims In case of group life insurance business, life insurance

companies settled 98.77 per cent claims during 2021-22

In case of individual life insurance business, the life industry's

against 98.62 per cent in the previous year.

death claim settlement ratio increased to 98.64 per cent in

2021-22 from 98.39 per cent in the previous year and the Insurer-wise claim details of individual and group life

repudiation/rejection ratio decreased to 1.02 per cent from insurance business are provided in Statement 7 and

1.14 per cent. Statement 8 respectively.

Actual Death Claims of Life Insurers

(Amount in Rs. crore)

NOP – No. of Policies

Note:

1. Figures in brackets are percentage to total.

2. For Individual life insurance business, the count is in terms of NOP and in case of group life insurance business, the

count is terms of number of lives

Investment Income of Life Insurers Life Reinsurance

Investment income (Policyholder's and Shareholder's) During 2021-22, ?605.76 crore was ceded as reinsurance

including capital gains and other income of life insurance premium by LIC (?442.21 crore in 2020-21). The private

industry declined by 10.58 per cent to ?4.17 lakh crore in insurers together ceded ?5,190.21 crore (?3908.92 crore in

2021-22. While LIC recorded 5.19 per cent growth, private 2020-21) as premium towards reinsurance. Retention ratio

insurers experienced 34.19 per cent decline in investment of Life insurers was 99.16 per cent for 2021-22 as against

income in the year 2021-22. 99.31 per cent for 2020-21.

Profits of Life Insurers

Profits of life insurance industry declined by 10.50 per cent in

2021-22 with profit after tax (PAT) of Rs. 7,751 crore as against

Rs. 8,661 crore in 2020-21. Out of the 24 life insurers in

operation during 2021-22, 15 companies reported profits. LIC

reported increase in profits by 39.39 per cent while private

insurers together reported a loss of 35.62 per cent in 2021-22.

The Insurance Times March 2023 41