Page 46 - Insurance Times March 2023

P. 46

Policies Issued by Life Insurers Ltd., Rs. 125 crore by IndiaFirst Life Insurance Co. Ltd., Rs.

496 crore by Max Life Insurance Co. Ltd., Rs. 400 crore by

During 2021-22, the life insurance industry registered a

PNB MetLife India Insurance Co. Ltd., Rs. 125 crore by Star

growth of 3.51 per cent in the number of new policies issued

Union Dai-ichi Life Insurance Co. Ltd., and Rs. 488 crore by

against the previous year. LIC registered a growth of 3.54

Tata AIA Life Insurance Co. Ltd.

per cent and contributed 74.60 per cent of the policies

issued. The private sector registered a growth of 3.38 per

Total Other Forms of Capital of life insurers as on March 31,

cent and contributed 25.40 per cent of the policies issued.

2022 was Rs. 4,194 crore (Rs. 2,210 crore as on March 31,

2021).

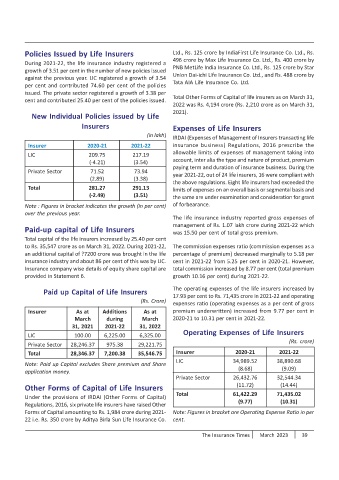

New Individual Policies issued by Life

Insurers Expenses of Life Insurers

(in lakh)

IRDAI (Expenses of Management of Insurers transacting life

Insurer 2020-21 2021-22 insurance business) Regulations, 2016 prescribe the

allowable limits of expenses of management taking into

LIC 209.75 217.19

account, inter alia the type and nature of product, premium

(-4.21) (3.54)

paying term and duration of insurance business. During the

Private Sector 71.52 73.94

year 2021-22, out of 24 life insurers, 16 were compliant with

(2.89) (3.38)

the above regulations. Eight life insurers had exceeded the

Total 281.27 291.13

limits of expenses on an overall basis or segmental basis and

(-2.49) (3.51)

the same are under examination and consideration for grant

Note : Figures in bracket indicates the growth (in per cent) of forbearance.

over the previous year.

The life insurance industry reported gross expenses of

management of Rs. 1.07 lakh crore during 2021-22 which

Paid-up capital of Life Insurers

was 15.50 per cent of total gross premium.

Total capital of the life insurers increased by 25.40 per cent

to Rs. 35,547 crore as on March 31, 2022. During 2021-22, The commission expenses ratio (commission expenses as a

an additional capital of ?7200 crore was brought in the life percentage of premium) decreased marginally to 5.18 per

insurance industry and about 86 per cent of this was by LIC. cent in 2021-22 from 5.25 per cent in 2020-21. However,

Insurance company wise details of equity share capital are total commission increased by 8.77 per cent (total premium

provided in Statement 6. growth 10.16 per cent) during 2021-22.

The operating expenses of the life insurers increased by

Paid up Capital of Life Insurers

17.93 per cent to Rs. 71,435 crore in 2021-22 and operating

(Rs. Crore)

expenses ratio (operating expenses as a per cent of gross

Insurer As at Additions As at premium underwritten) increased from 9.77 per cent in

March during March 2020-21 to 10.31 per cent in 2021-22.

31, 2021 2021-22 31, 2022

Operating Expenses of Life Insurers

LIC 100.00 6,225.00 6,325.00

(Rs. crore)

Private Sector 28,246.37 975.38 29,221.75

Total 28,346.37 7,200.38 35,546.75 Insurer 2020-21 2021-22

LIC 34,989.52 38,890.68

Note: Paid up Capital excludes Share premium and Share

(8.68) (9.09)

application money.

Private Sector 26,432.76 32,544.34

(11.72) (14.44)

Other Forms of Capital of Life Insurers

Total 61,422.29 71,435.02

Under the provisions of IRDAI (Other Forms of Capital)

(9.77) (10.31)

Regulations, 2016, six private life insurers have raised Other

Forms of Capital amounting to Rs. 1,984 crore during 2021- Note: Figures in bracket are Operating Expense Ratio in per

22 i.e. Rs. 350 crore by Aditya Birla Sun Life Insurance Co. cent.

The Insurance Times March 2023 39