Page 35 - Insurance Times May 2022

P. 35

ROLE OF RISK

MANAGEMENT

PROFESSIONALS

IN EMERGING

ECONOMIES

Introduction professionals will assess and identify the risk faced by the

organization due to emerging economies. Based on such

In the current ever-changing economic scenario, different

identifications of risk, concrete steps are taken to manage

risks require different techniques to deal with them. There

are fewer chances that the risk varies in developed the volatilities and uncertainties (Olsson, 2002). The

economies. However, there is a high probability that there following are the risks faced in emerging economies and risk

are various risks in emerging economies that are management professionals' roles to reduce or eliminate

continuously and quickly changing. Managing the risk in them.

developed economies is not so challenging than an

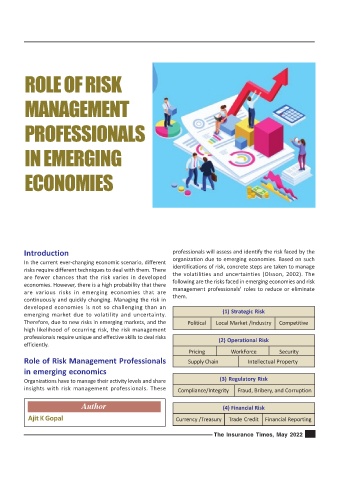

emerging market due to volatility and uncertainty. (1) Strategic Risk

Therefore, due to new risks in emerging markets, and the Political Local Market /Industry Competitive

high likelihood of occurring risk, the risk management

professionals require unique and effective skills to deal risks (2) Operational Risk

efficiently.

Pricing WorkForce Security

Role of Risk Management Professionals Supply Chain Intellectual Property

in emerging economics

Organizations have to manage their activity levels and share (3) Regulatory Risk

insights with risk management professionals. These Compliance/Integrity Fraud, Bribery, and Corruption

Author (4) Financial Risk

Ajit K Gopal Currency /Treasury Trade Credit Financial Reporting

The Insurance Times, May 2022 35