Page 42 - Insurance Times July 2021

P. 42

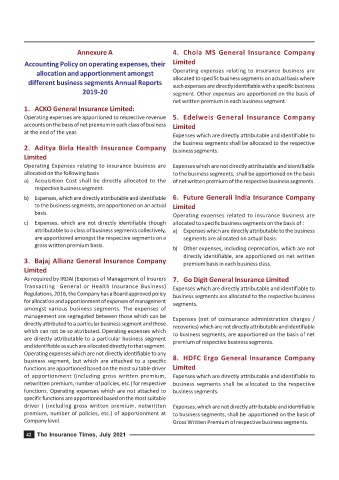

Annexure A 4. Chola MS General Insurance Company

Accounting Policy on operating expenses, their Limited

allocation and apportionment amongst Operating expenses relating to insurance business are

allocated to specific business segments on actual basis where

different business segments Annual Reports

such expenses are directly identifiable with a specific business

2019-20 segment. Other expenses are apportioned on the basis of

net written premium in each business segment.

1. ACKO General Insurance Limited:

Operating expenses are apportioned to respective revenue 5. Edelweis General Insurance Company

accounts on the basis of net premium in each class of business Limited

at the end of the year.

Expenses which are directly attributable and identifiable to

the business segments shall be allocated to the respective

2. Aditya Birla Health Insurance Company business segments.

Limited

Operating Expenses relating to insurance business are Expenses which are not directly attributable and identifiable

allocated on the following basis to the business segments, shall be apportioned on the basis

a) Acquisition Cost shall be directly allocated to the of net written premium of the respective business segments.

respective business segment.

b) Expenses, which are directly attributable and identifiable 6. Future Generali India Insurance Company

to the business segments, are apportioned on an actual Limited

basis. Operating expenses related to insurance business are

c) Expenses, which are not directly identifiable though allocated to specific business segments on the basis of :

attributable to a class of business segments collectively, a) Expenses which are directly attributable to the business

are apportioned amongst the respective segments on a segments are allocated on actual basis.

gross written premium basis.

b) Other expenses, including depreciation, which are not

directly identifiable, are apportioned on net written

3. Bajaj Allianz General Insurance Company premium basis in each business class.

Limited

As required by IRDAI (Expenses of Management of Insurers 7. Go Digit General Insurance Limited

Transacting General or Health Insurance Business) Expenses which are directly attributable and identifiable to

Regulations, 2016, the Company has a Board approved policy

business segments are allocated to the respective business

for allocation and apportionment of expenses of management segments.

amongst various business segments. The expenses of

management are segregated between those which can be Expenses (net of coinsurance administration charges /

directly attributed to a particular business segment and those recoveries) which are not directly attributable and identifiable

which can not be so attributed. Operating expenses which to business segments, are apportioned on the basis of net

are directly attributable to a particular business segment premium of respective business segments.

and identifiable as such are allocated directly to that segment.

Operating expenses which are not directly identifiable to any

business segment, but which are attached to a specific 8. HDFC Ergo General Insurance Company

functions are apportioned based on the most suitable driver Limited

of apportionment (including gross written premium, Expenses which are directly attributable and identifiable to

netwritten premium, number of policies, etc.) for respective business segments shall be allocated to the respective

functions. Operating expenses which are not attached to business segments.

specific functions are apportioned based on the most suitable

driver ( (including gross written premium, netwritten Expenses, which are not directly attributable and identifiable

premium, number of policies, etc.) of apportionment at to business segments, shall be apportioned on the basis of

Company level. Gross Written Premium of respective business segments.

42 The Insurance Times, July 2021