Page 40 - Insurance Times July 2021

P. 40

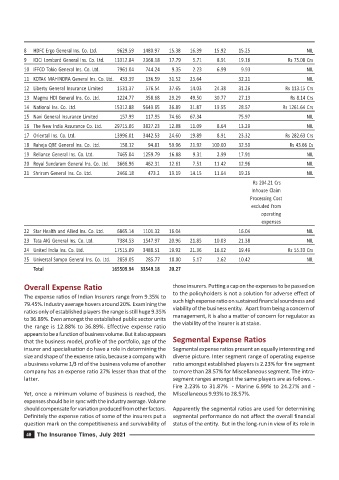

8 HDFC Ergo General Ins. Co. Ltd. 9629.59 1480.97 15.38 16.39 15.92 15.25 NIL

9 ICICI Lombard General Ins. Co. Ltd. 13312.84 2368.18 17.79 5.71 8.91 19.16 Rs 75.08 Crs

10 IFFCO Tokio General Ins. Co. Ltd. 7961.04 744.24 9.35 2.23 6.99 9.93 NIL

11 KOTAK MAHINDRA General Ins. Co. Ltd. 433.39 136.59 31.52 23.64 32.21 NIL

12 Liberty General Insurance Limited 1531.37 576.54 37.65 14.03 24.38 31.26 Rs 113.15 Crs

13 Magma HDI General Ins. Co. Ltd. 1224.77 358.68 29.29 49.50 30.77 27.13 Rs 8.14 Crs

14 National Ins. Co. Ltd. 15312.88 5649.65 36.89 31.87 19.55 28.57 Rs 1261.64 Crs

15 Navi General Insurance Limited 157.99 117.95 74.66 67.34 75.97 NIL

16 The New India Assurance Co. Ltd. 29715.06 3827.23 12.88 11.09 8.64 13.29 NIL

17 Oriental Ins. Co. Ltd. 13996.01 3442.53 24.60 19.89 8.91 23.32 Rs 282.63 Crs

18 Raheja QBE General Ins. Co. Ltd. 158.12 94.81 59.96 21.92 100.00 32.59 Rs 43.66 Cs

19 Reliance General Ins. Co. Ltd. 7465.04 1259.79 16.88 9.31 2.99 17.91 NIL

20 Royal Sundaram General Ins. Co. Ltd. 3666.96 462.31 12.61 7.51 11.42 12.96 NIL

21 Shriram General Ins. Co. Ltd. 2466.18 473.2 19.19 14.15 11.64 19.26 NIL

Rs 204.21 Crs

Inhouse Claim

Processing Cost

excluded from

operating

expenses

22 Star Health and Allied Ins. Co. Ltd. 6865.14 1101.32 16.04 16.04 NIL

23 Tata AIG General Ins. Co. Ltd. 7384.53 1547.97 20.96 21.85 10.03 21.38 NIL

24 United India Ins. Co. Ltd. 17515.09 3488.51 19.92 21.36 16.62 19.49 Rs 55.33 Crs

25 Universal Sompo General Ins. Co. Ltd. 2859.05 285.77 10.00 5.17 2.62 10.42 NIL

Total 165509.94 33549.18 20.27

Overall Expense Ratio those insurers. Putting a cap on the expenses to be passed on

to the policyholders is not a solution for adverse effect of

The expense ratios of Indian Insurers range from 9.35% to

79.45%. Industry average hovers around 20%. Examining the such high expense ratio on sustained financial soundness and

ratios only of established players the range is still huge 9.35% viability of the business entity. Apart from being a concern of

to 36.89%. Even amongst the established public sector units management, it is also a matter of concern for regulator as

the range is 12.88% to 36.89%. Effective expense ratio the viability of the insurer is at stake.

appears to be a function of business volume. But it also appears

that the business model, profile of the portfolio, age of the Segmental Expense Ratios

insurer and specialisation do have a role in determining the Segmental expense ratios present an equally interesting and

size and shape of the expense ratio, because a company with diverse picture. Inter segment range of operating expense

a business volume 1/3 rd of the business volume of another ratio amongst established players is 2.23% for fire segment

company has an expense ratio 27% lesser than that of the to more than 28.57% for Miscellaneous segment. The intra-

latter. segment ranges amongst the same players are as follows. -

Fire 2.23% to 31.87% - Marine 6.99% to 24.27% and -

Yet, once a minimum volume of business is reached, the Miscellaneous 9.93% to 28.57%.

expenses should be in sync with the industry average. Volume

should compensate for variation produced from other factors. Apparently the segmental ratios are used for determining

Definitely the expense ratios of some of the insurers put a segmental performance do not affect the overall financial

question mark on the competitiveness and survivability of status of the entity. But in the long-run in view of its role in

40 The Insurance Times, July 2021